Daily Market Analysis and Forex News

Brent rebound faces NFP, OPEC+ test

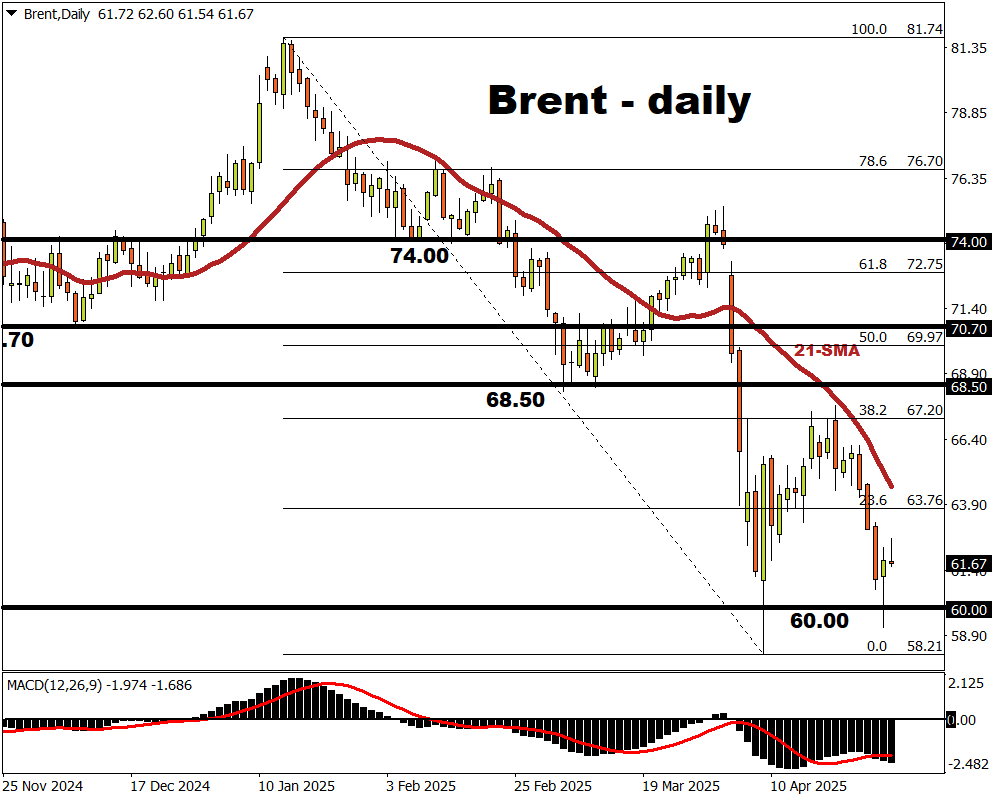

- Brent initially rebounded after Trump's latest sanction threat on Iran oil sales; seemingly thawing US-China geopolitical tensions

- Brent's rebound off 4-year lows already faltering at the time of writing

- Still ahead: Key US jobs report due Friday, OPEC+ supply hike decision on Monday

- NFP and OPEC+ outcomes could determine whether Brent sinks to a new 4-year low

- Resilient US jobs market and smaller OPEC+ June output hike could see Brent's 21-day SMA tested as resistance

Brent bulls are trying to keep prices above $60/bbl.

Brent had initially rebounded from near-4-year lows after President Trump threatened more sanctions on Iran’s oil sales, while US-China geopolitical tensions show flickering signs of relief.

However, today's spike up has already been unwound at the time of writing.

Still, whether Brent’s presence above $60/bbl can be sustained will boil down to today’s crucial US jobs report and Monday’s pivotal OPEC+ supply decision.

- Brent may tumble below $60 again if markets are shown a weaker-than-expected US labour market.

The global oil benchmark would then be likelier to see a fresh 4-year low if OPEC+ proceeds with another bumper-sized supply hike.

- However, Brent bulls may look to retest its 21-day moving average for resistance upon seeing a still-resilient US jobs market and a lower-than-expected OPEC+ output hike for June.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.