Daily Market Analysis and Forex News

Brent rebounds amid mixed signals

- Brent rebounds heading into the weekend

- Technical factors include a shift in RSI indicators

- Storm Francine disrupts a third of Gulf oil production

- IEA's outlook raises concerns about future demand

- Fed's dovish stance may impact oil price sustainability

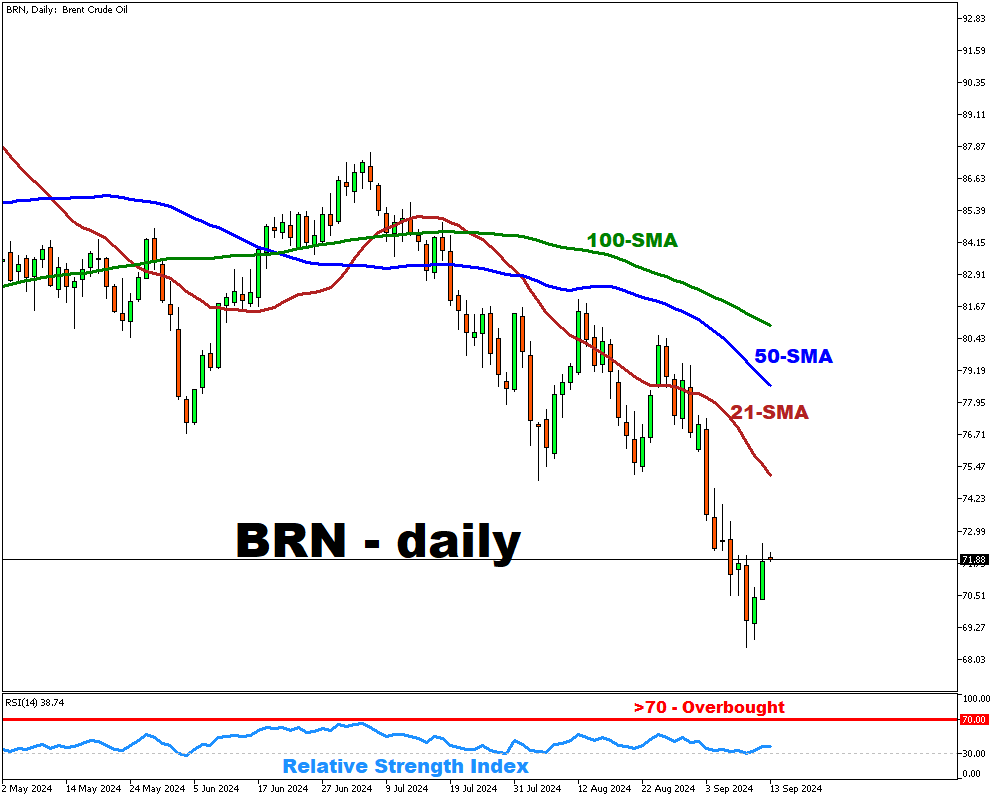

Brent crude oil is experiencing a rebound heading into the weekend, driven by both technical and fundamental factors.

The technical rebound is largely due to the 14-day Relative Strength Index moving out of oversold territory.

In addition, Storm Francine has caused disruptions, affecting about a third of oil production in the Gulf region. However, this bounce may be short-lived.

If the Federal Reserve adopts a more dovish stance next week, this could lead to a further decline in the US dollar, which could support oil prices.

Despite this potential boost, the International Energy Agency (IEA) recently issued a pessimistic outlook for oil.

If the IEA scenario prevails, oil benchmarks may struggle to make significant gains as long as concerns about demand persist.

The interplay between monetary policy and demand concerns will be crucial in determining the sustainability of this moderate recovery in oil prices.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.