Daily Market Analysis and Forex News

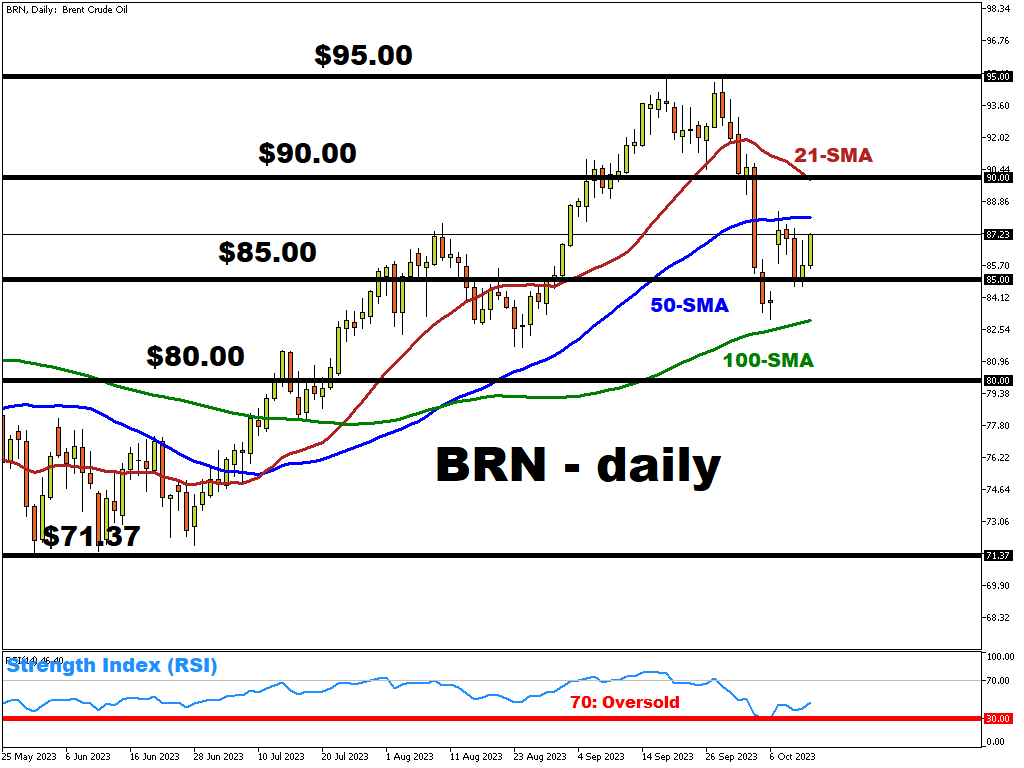

BRN oscillates around $87 amid growing geopolitical risks

Oil prices continue to stay elevated above $85/bbl amid both geopolitical tensions in the Middle East and a new pack of US sanctions targeting Russian Crude exports.

With Russia-Saudi combined 1.3 million bbl/day voluntary supply cut extensions put in place, investors are now closely monitoring any developments in the Middle East.

Any further escalation of the conflict and/or involvement of any major regional oil producer (e.g. Iran) may have a strong immediate effect on oil prices.

Newly imposed US sanctions targeting Russian oil exports may further tighten the global supply, thus potentially extending additional support to the BRN bulls.

However, this week’s surprise surge in US crude inventory (10.2M climb vs 1.4M contraction forecasted) may stoke concerns of demand destruction in the world’s largest economy and drag on global oil benchmarks.

From a technical perspective …

- BRN’s 50-day simple moving average (SMA) around $88.065 has offered strong resistance so far this week, indicating that oil bulls have to find even more reasons to push even higher

- To the downside, the 100-period SMA is located below the BRN spot price at 82.944, which may ultimately offer strong support

- A potential consolidation pattern may from within $85-$88 as investors await new market developments surrounding the ongoing Middle East conflict, as well as the next policy moves by major central banks

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.