Daily Market Analysis and Forex News

Gold attempts slight rebound ahead of US jobs report

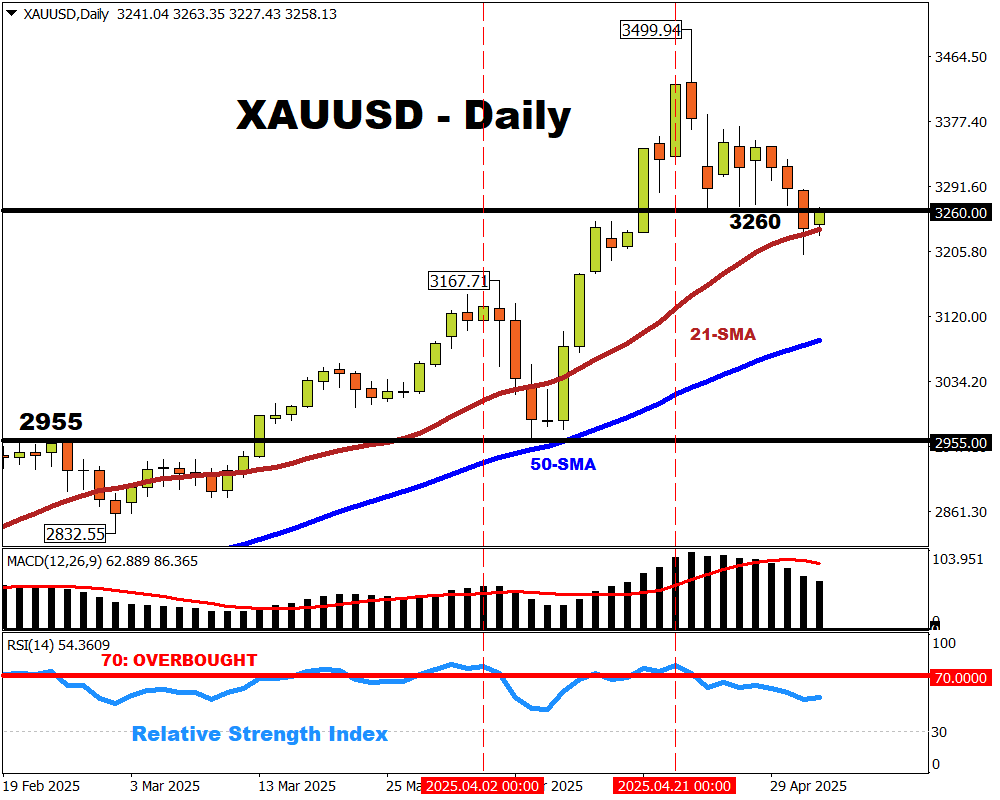

- XAUUSD set for back-to-back weekly declines for first time so far in 2025

- Improving risk appetite pulling gold away from record high

- Gold found support at 21-day SMA; now testing $3260 resistance

- Incoming NFP could dictate whether gold enters weekend above/below $3300

Gold is on course for 2 straight weekly declines.

After falling 0.2% in the week prior, XAUUSD is set for a 1.8% weekly drop this week, at the time of writing.

Risk appetite is creeping back into markets, which in turn is dampening some of this safe haven’s appeal.

However, XAUUSD is paring the drop on this Friday ahead of the pivotal US jobs report.

Having found support at its 21-day simple moving average (SMA), it's now testing resistance around $3260, with this price line going from a key support level in recent sessions now turned resistance.

Here's what economists predict for the US April jobs report:

- Headline NFP: 138,000 new jobs added

(If so, that would be lower than March's 209,000 headline NFP figure)

- Unemployment rate: 4.2%

(If so, that would match March's 4.2% jobless rate)

- Average hourly earnings month-on-month (April 2025 vs. March 2025): 0.3%

(If so, that would match March's 0.3% m/m growth)

- Average hourly earnings year-on-year (April 2025 vs. April 2024): 3.9%

(If so, that would be slightly higher than March's 3.8% y/y growth)

Potential NFP reaction

- If today’s NFP points to a weakening US labour market, which in turn hastens the next Fed rate cut, that should help gold punch back above $3300.

- However, gold’s immediate support at the 21-day moving average could give way if the NFP unveils still-resilient hiring while unemployment remains in check.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.