Daily Market Analysis and Forex News

Gold Surpasses $2,660 Amid Geopolitical Tensions

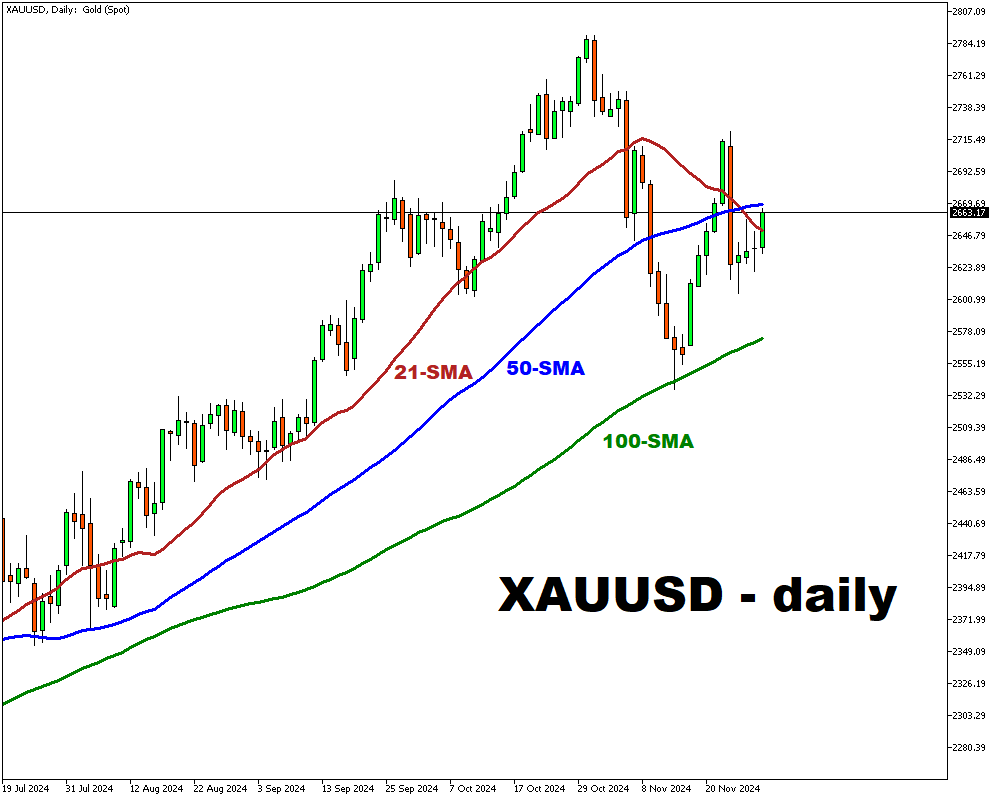

- Gold up ~1%, surpassing $2,660 per ounce

- Geopolitical tensions boost safe-haven demand

- Despite the rise, gold is set to decline around 2% for the week

- Fed rate cut odds rise from 55% to 66%

- Inflation and geopolitical risks may support gold longer term

Gold rose about 1% to surpass $2,660 per ounce on Friday, extending its rally for the fourth consecutive session.

The gains were driven by a softer US dollar and rising geopolitical tensions.

President Putin warned of a potential retaliatory strike, while Israel and Hezbollah accused each other of breaching a ceasefire.

These factors fueled safe-haven demand, further supporting gold prices.

Despite the rise, gold is set to decline around 2% for the week as markets await US data for insights into the Federal Reserve's monetary policy.

The softening dollar helped gold recover some of its earlier losses, while rising odds for a 25-basis point rate cut by the Fed in December added to the metal's appeal.

Odds for the rate cut have climbed from 55% to 66% since Monday.

Core PCE prices in October met expectations, keeping hopes for a December rate cut intact.

However, other data showed a resilient US economy, which could prompt the Fed to take a cautious approach next year.

Gold is also facing monthly losses for the first time since June, but inflationary pressures and geopolitical risks may support the metal in the longer term.

If inflationary pressures persist, gold’s role as an inflation hedge could drive prices higher in the years ahead.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.