Daily Market Analysis and Forex News

Trade Talk Turns Tame. Is the US500 Buying It?

- US500 gaps up +1.35% on trade optimism.

- Trump softens stance on China, Powell; Bessent signals possible China de-escalation.

- US PMIs & Fed Beige Book may drive next short-term moves

- If 21-SMA resistance is conquered, US500 could soar over 100 index points

ICYMI, the US500 has rebounded nearly 13% since posting a one-year low earlier this month.

Recall on April 7th, the US500 printed an intraday price of 4801.2 - its lowest intraday price since January 2024.

Since then, it has rebounded to once again test its 21-day simple moving average (SMA) as resistance.

Why are US stock indices climbing today?

Today, the US500 gapped up 1.35% at Wednesday’s open.

These gains have been driven by a shift in sentiment following upbeat trade commentary out of Washington and a softer geopolitical stance that helped ease investor concerns:

- US Treasury Secretary Scott Bessent called the ongoing trade tensions between the US and China “unsustainable,” signalling potential de-escalation ahead.

- US President Donald Trump appeared to dial back earlier comments aimed at Federal Reserve Chair Jerome Powell, with the former saying that he had "no intention" on firing the latter as the Fed Chair.

Recall last Monday’s sharp pullback of over 2% had largely stemmed from Trump’s earlier criticism of Powell, which rattled rate-sensitive sectors and triggered a broad risk-off move.

The reversal in tone helped restore confidence and revive demand for US equities.

Adding to the bullish momentum were reports of potential trade deals with Japan and India - among two of the US’s largest partners—as well as a more measured tone from the White House on tariff policy.

April 23: Key Events

Volatility in the US500 could pick up later in the session with two key releases on deck:

- US April PMIs (13:45 GMT)

Historically, PMI releases have acted as significant short-term catalysts moving as much as 0.8% to the upside or 2.4% to the downside within six hours following the data.

- Federal Reserve Beige Book (18:00 GMT)

Traders will be watching for clues on how trade-related uncertainty is filtering through the real economy.

A positive tone could reinforce bullish sentiment in equities, while signs of slowing momentum may add pressure.

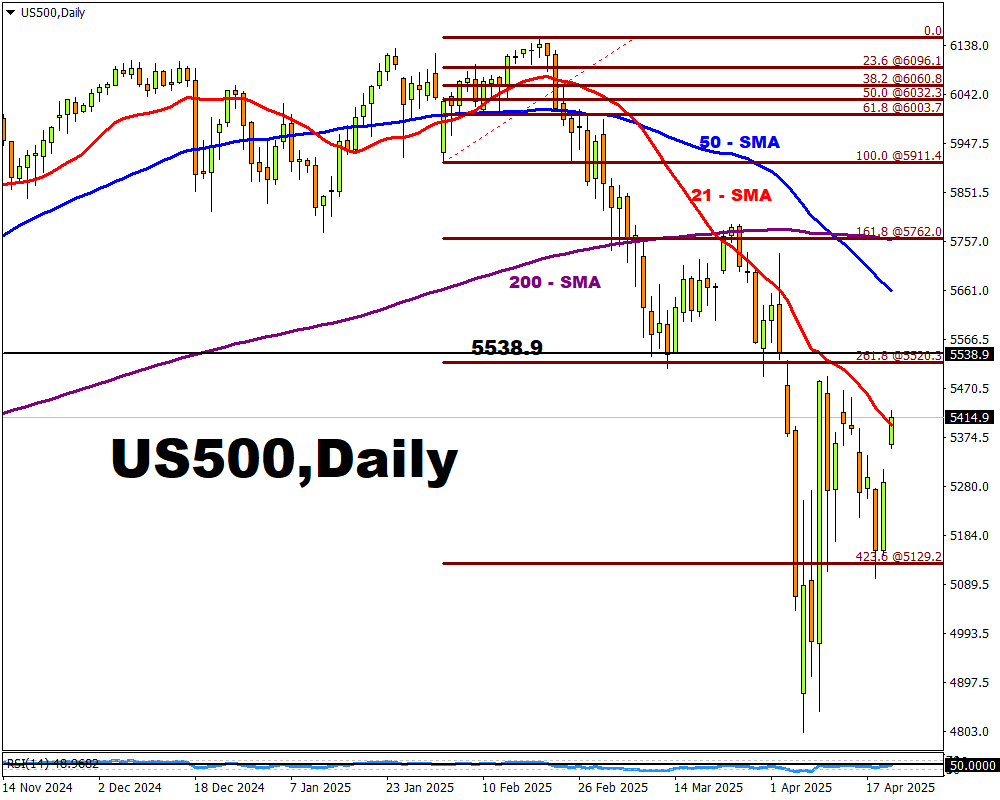

Technical Setup: US500, Daily

As mentioned earlier, at the time of writing, the US500 is testing its 21-day simple moving average (SMA).

A decisive daily close above this level could pave the way for a rally of approximately 123 index points!

If so, this would fill the April 2nd gap down (5538.9), in a zone that also aligns with the 261.8% Fibonacci extension at 5520.3.

Other potential resistance zones that bulls may observe include

- 5618 – 50-day SMA

- 5762 – confluence of the 161.8% Fibonacci extension and the 200-day SMA

Conversely, bears may pay attention to the following support levels on the daily timeframe:

- 5313.2 – yesterday’s close and session open

- 5129.2 – 423.6% Fibonacci level

- 4801.2 – the most recent swing low

Fibonacci levels are anchored from the February 3 low (5911.4) to the February 19 high (6036.6).

Still, it's too early to cite the all-clear for risk assets.

The latest rhetoric surrounding the Trump administration's policies may prove to be a head fake.

After all, the world knows how erratic POTUS can be, with the penchant for swift flip-flops that turn risk sentiment on its head.

Hence, proper risk management is fully warranted, as should always be the case, as traders and investors seek to exploit opportunities during these volatile yet potentially rewarding times.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.