Daily Market Analysis and Forex News

Week Ahead: EURUSD set for another wild ride

Fasten your seatbelts because global financial markets could experience heightened volatility in the week ahead!

Investors will be bombarded with a long list of high-risk events ranging from pivotal central bank meetings, top-tier data from major economies and corporate earnings from the largest companies in the world.

But before we pinpoint what asset to watch out for amid the expected action, here are the scheduled economic data releases and events over the coming week:

Monday, July 24

- JPY: Japan Judo Bank Manufacturing PMI

- EUR: Eurozone & Germany S&P Global PMIs

- GBP: UK S&P Global/CIPS Manufacturing & Services PMI

Tuesday, July 25

- EUR: Germany IFO business climate

- USD: US Conf. Board consumer confidence

- NQ100_m: Microsoft Corp earnings

Wednesday, July 26

- AUD: Australia CPI

- USD: FOMC rate decision, US new home sales

- SPX500_m: Coca-Cola earnings

Thursday, July 27

- CNH: China industrial profits

- EUR: ECB rate decision

- USD: US Q2 GDP, durable goods, initial jobless claims

- SPX500_m: McDonald’s Corp earnings

Friday, July 28

- AUD: Australia retail sales

- EUR: Germany CPI, Eurozone economic confidence, consumer confidence

- JPY: BoJ rate decision, Tokyo CPI

- USD: US June PCE report, University of Michigan consumer sentiment

Indeed, the barrage of high-risk events could translate into fresh trading opportunities across financial markets. However, our attention will be directed to none other than the world’s most popular traded currency, which is set to be heavily influenced by the central bank combo and key reports.

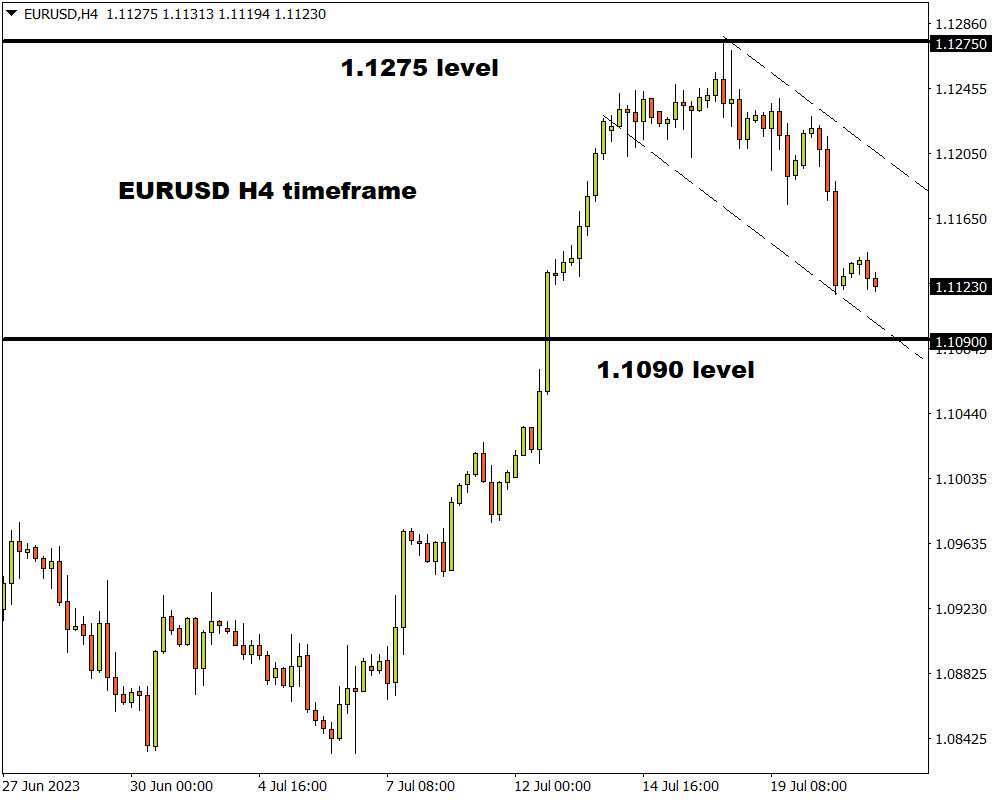

But before we break down the factors that could see the EURUSD end July with a bang, it is worth keeping in mind that the currency seems to be under pressure on the H4 charts. After hitting a 17-month high at 1.1275, bulls seem to be running out of steam with bears greedily eyeing support at 1.1090. The events in the upcoming week could dictate whether prices rebound or sink lower.

Here are 4 reasons why you should not take your eyes off the EURUSD:

-

Fed meeting

Markets widely expect the Federal Reserve to raise interest rates by 25 basis points on Wednesday, taking the upper band of the Fed funds to 5.5%. The question is whether this will be the hike that ends the central bank’s aggressive hiking campaign. Given the mixed US economic data over the past few weeks, Fed Chair Jerome Powell’s remarks at the press conference are likely to be closely scrutinized by investors for fresh clues on future monetary policy.

- Should the Fed signal more rate hikes down the road, this could inject dollar bulls with renewed inspiration – dragging the EURUSD lower.

- If the Fed hints it's done with raising rates, the dollar is likely to find itself under fresh selling pressure – resulting in the EURUSD pushing higher.

It is worth keeping in mind that traders are currently pricing in a 96% probability of a 25bps hike next week, with the probability of another 25 bps hike by November's meeting only at 35%.

-

ECB meeting

The European Central Bank is expected to raise interest rates by 25 basis points on Thursday. Cooling inflationary pressures continue to support expectations around the central bank moving closer to ending its hiking cycle. Nevertheless, President Christine Lagarde is expected to reiterate that the ECB is unlikely to ease anytime soon with the decision in September depending on economic data.

- The euro could push higher if the ECB strikes a hawkish note and signals more rate hikes beyond July’s policy meeting. This may trigger a rebound in the EURUSD.

- A cautious-sounding ECB that signals a pause in hikes down the line could weaken the euro, pulling the EURUSD lower.

-

Top-tier data dump

Throughout the trading week, investors will be dished out a platter of key economic reports from the United States and Europe which could rock the EURUSD.

On Monday, all eyes will be on key PMI reports from the Eurozone and Germany. Tuesday see’s the Germany IFO business climate figures and US Conf. Board consumer confidence data. The dollar could be injected with more volatility on Thursday due to the second quarter of US GDP figures and the initial jobless claims report. On Friday, inflation data from the largest economy in Europe will be under the spotlight. This will be complemented by the latest Eurozone economic and consumer confidence figures. To wrap up the week, much focus will be directed towards the June PCE Core Deflator which is the Fed’s preferred measure of inflation and University of Michigan consumer sentiment.

- Should the pending US/Eurozone print above markets expectations, this may support speculation around rates remaining higher for longer – lending support to respective currency.

- If the incoming data from the US/Eurozone disappoint, this could reinforce speculation around the hiking cycle coming to an end – weakening the respective currency.

-

Technical forces

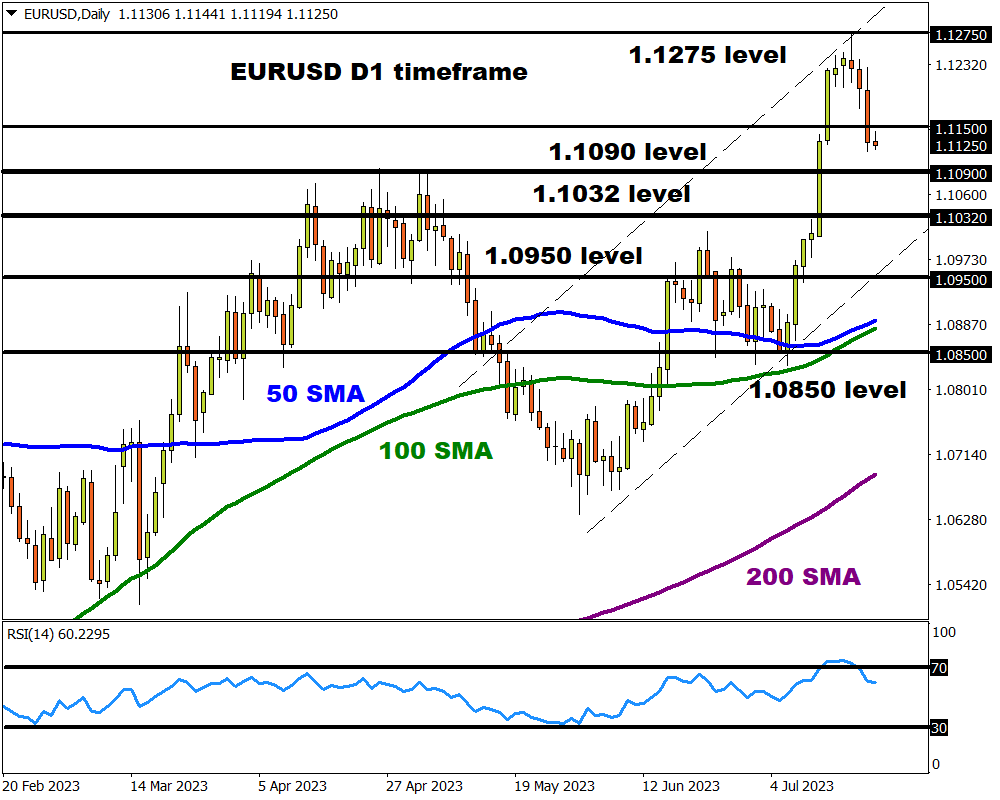

EURUSD has found itself under selling pressure after hitting a 17-month high at 1.1275. Indeed, the Relative Strength Index (RSI) was already at overbought levels with bears wasting no time to attack following the breakdown below 1.1200.

Despite the recent losses, the EURUSD remains in an uptrend on the daily charts with bulls maintaining some control above 1.1032. A technical throwback could be in the process which may see prices rebound back towards 17-month highs in the week ahead. Alternatively, a solid breakdown under 1.1032 may trigger a further selloff towards 1.0950 and 1.0850, respectively.

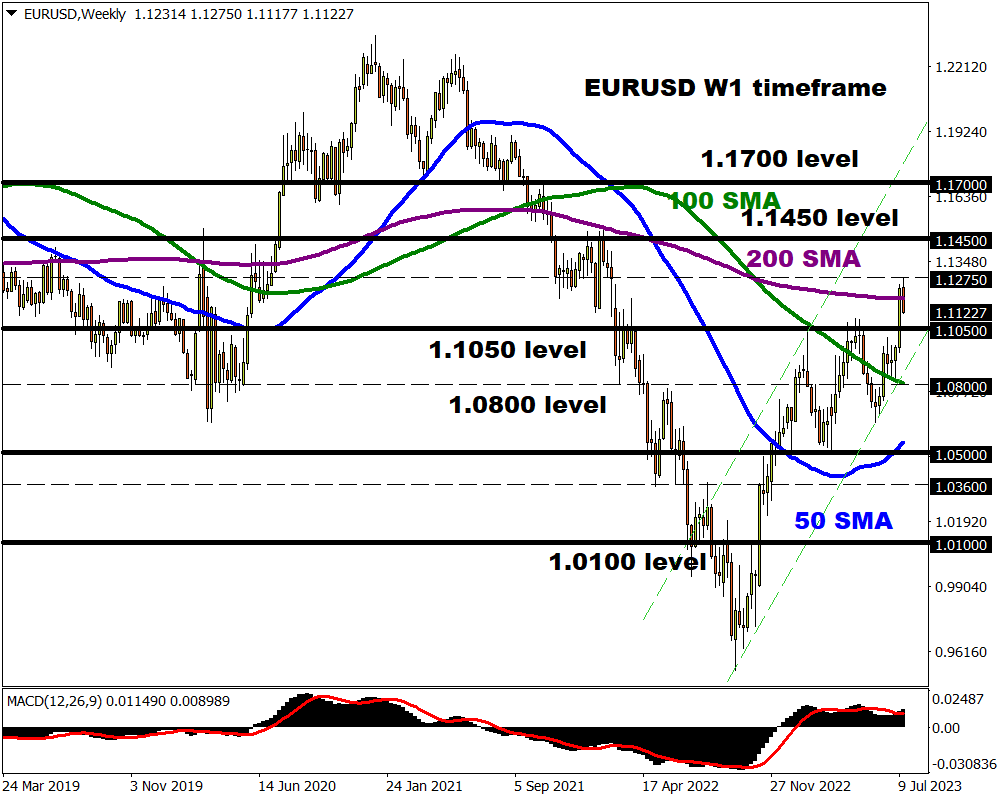

Zooming out into the weekly charts, prices remain in a bullish weekly channel. However, strong resistance can be found around the 200-week SMA. Should 1.1050 prove to be reliable support, this may provide a foundation for bulls to retest 1.1275 and beyond. Alternatively, a weekly close under 1.1050 may open a path back toward 1.0800.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.