Daily Market Analysis and Forex News

XAUUSD & BRN are under pressure amid stronger dollar.

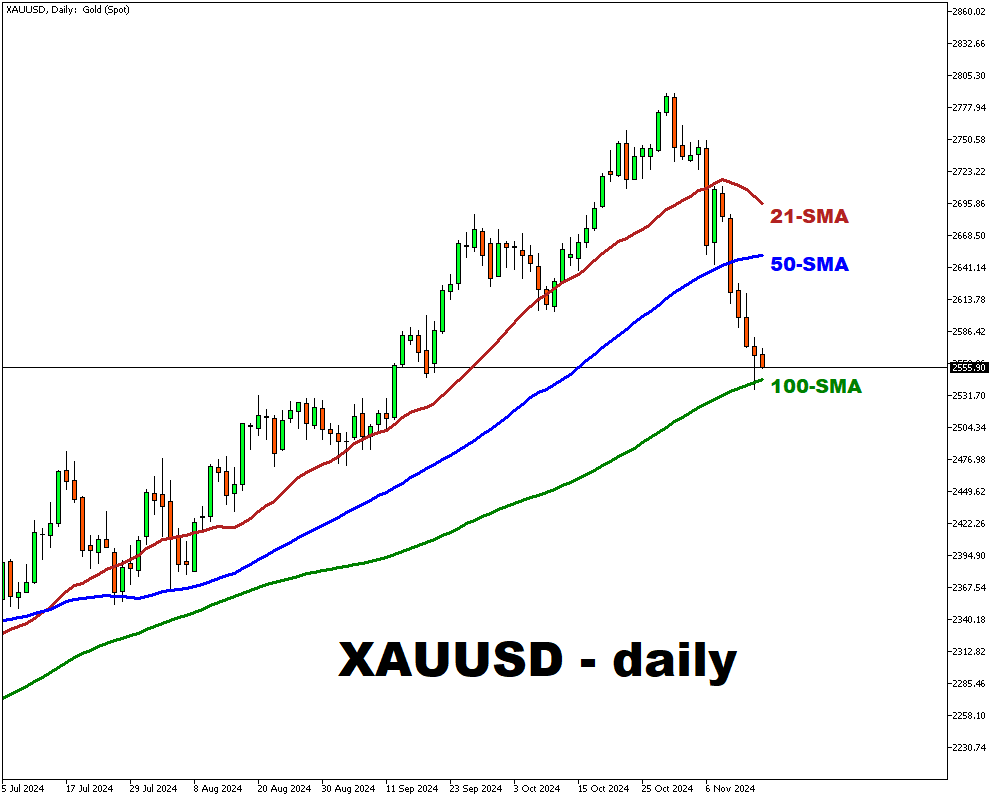

- Gold price drops below $2,560 per ounce

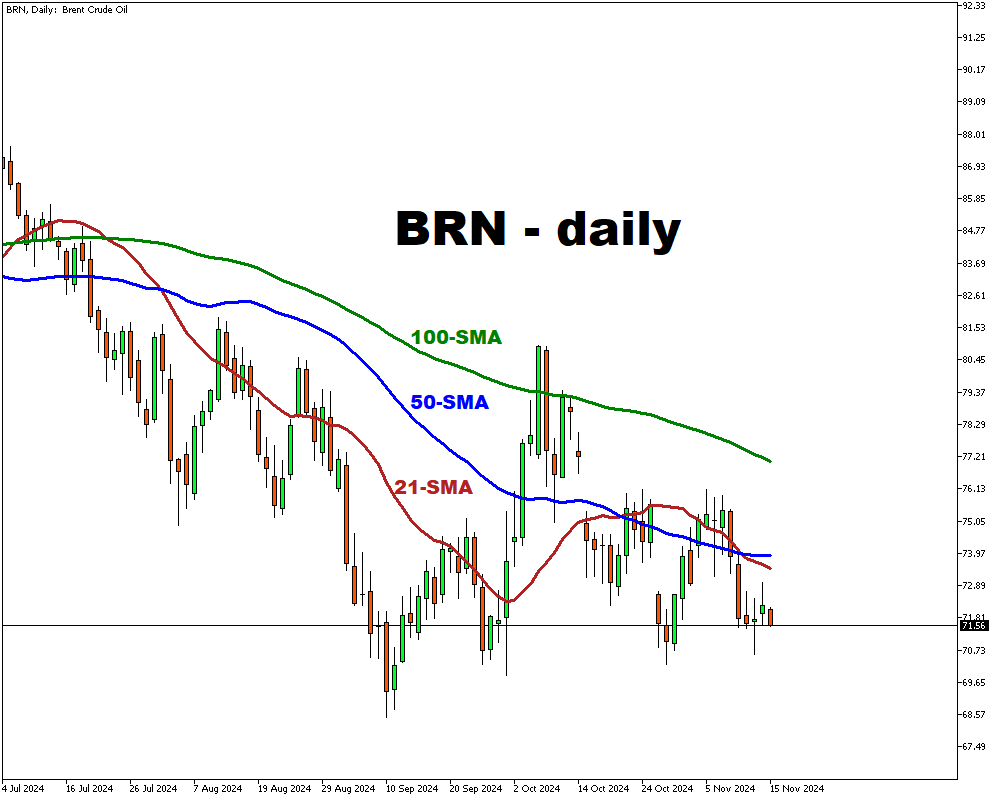

- Brent crude falls below $72 per barrel

- Strong US dollar impacts commodity attractiveness

- Fed rate cut hopes diminish after Powell's remarks

- IEA forecasts oil surplus due to rising production

A perfect storm of factors is battering the prices of gold and oil, with both commodities experiencing a significant downturn.

The value of gold has plummeted below $2,560 per ounce, marking its worst weekly performance since June 2021. Meanwhile, Brent crude has slipped below $72 per barrel, snapping a three-week winning streak.

The US dollar's surge to a two-year high is a major contributor to the decline in both gold and oil prices.

A strong dollar makes commodities priced in the currency less attractive to investors.

In the case of gold, the loss of appeal is compounded by dwindling hopes for a Federal Reserve rate cut.

Fed Chair Powell's recent comments, which highlighted the economy's resilience, a robust labor market, and persistent inflation, have led to a decline in market confidence for a December rate reduction.

The prospect of a rate cut has become less likely, with traders now assigning a 58% probability to such an event, down from 80% prior to Powell's remarks.

Furthermore, the incoming administration's potential policies, including higher trade tariffs, tax cuts, and increased deficit spending, may fuel inflation and limit the Fed's ability to lower borrowing costs.

In the oil market, concerns about a looming surplus are driving prices down.

The International Energy Agency (IEA) has forecast a surplus in 2024, citing slowing demand growth in China and rising global production.

The agency warned that the surplus could be exacerbated if OPEC+ proceeds with plans to restore previously halted production.

Additionally, data from the Energy Information Administration (EIA) showed that US crude inventories rose by 2.1 million barrels last week, exceeding expectations.

However, a sharp 4.4-million-barrel drawdown in gasoline stocks was also reported, marking the lowest level in a decade for this time of year.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.