Daily Market Analysis and Forex News

XAUUSD surges to record high amid rate cut expectations

- Gold prices increased by over 1% to $2,554.05 an ounce

- A 57% chance of a 25 basis point rate cut is anticipated at the Fed's upcoming meeting

- Rising US jobless claims and producer prices are indicating economic slowdown

- Other precious metals, including palladium, silver, and platinum, also saw notable price increases

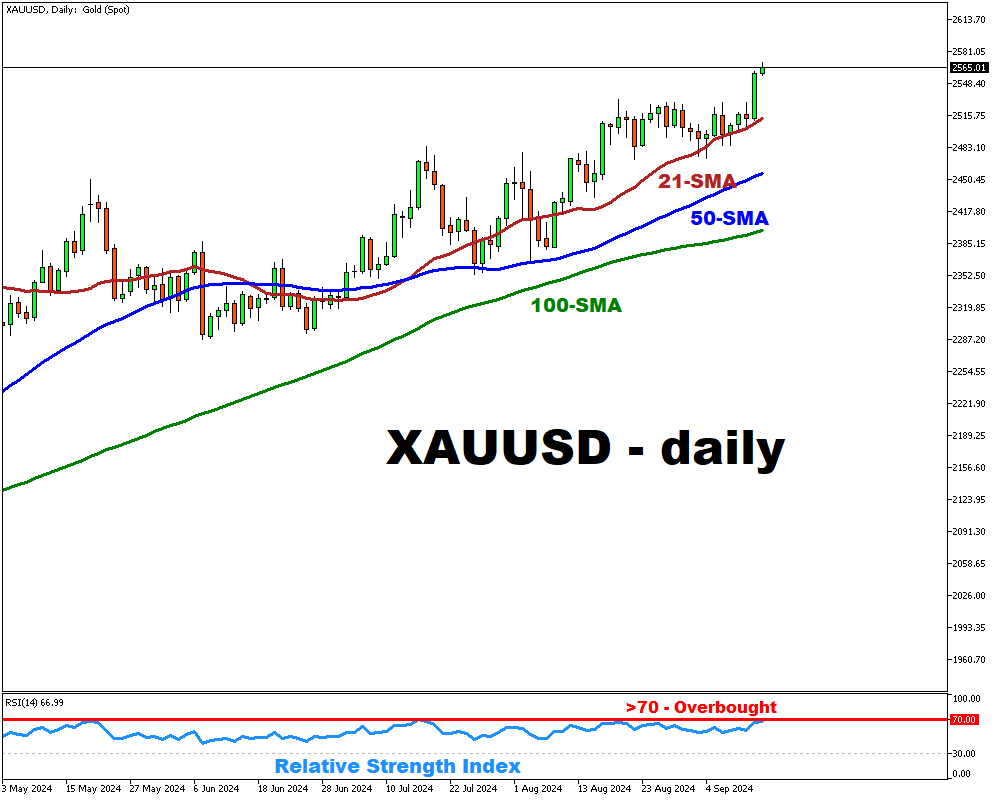

- Gold is trading above key simple moving averages, indicating a strong bullish trend

Gold prices hit a record high on Thursday, rising more than 1% to $2,554.05 an ounce on expectations of an interest rate cut by the Federal Reserve.

The U.S. Labor Department reported a rise in initial jobless claims and a slight increase in producer prices, signaling a slowing economy.

At the time of writing, markets are pricing in a 57% chance of a 25 basis point rate cut at the Fed's September 17-18 meeting.

As a result, gold, which tends to perform well in a low interest rate environment, became more attractive to investors.

Other precious metals also saw gains, with palladium rising 4.1% to $1,050 an ounce, its highest in over two months, on the back of potential export restrictions on Russian nickel production.

Silver and platinum were also higher, with silver up 3.7% to $29.76 and platinum up 3% to $979.62.

From the technical prospective…

Gold is trading above three important simple moving averages (SMAs), underscoring a strong bullish trend in both the medium and long term.

The Relative Strength Index (RSI) remains within the 70-30 range (>70 - overbought; <30 - oversold) despite yesterday's sharp spike.

On the downside, $2560 could provide immediate support, followed by the 21-period SMA at ~$2512.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.