Daily Market Analysis and Forex News

BRN is trying to recover, moving away from $74/bbl

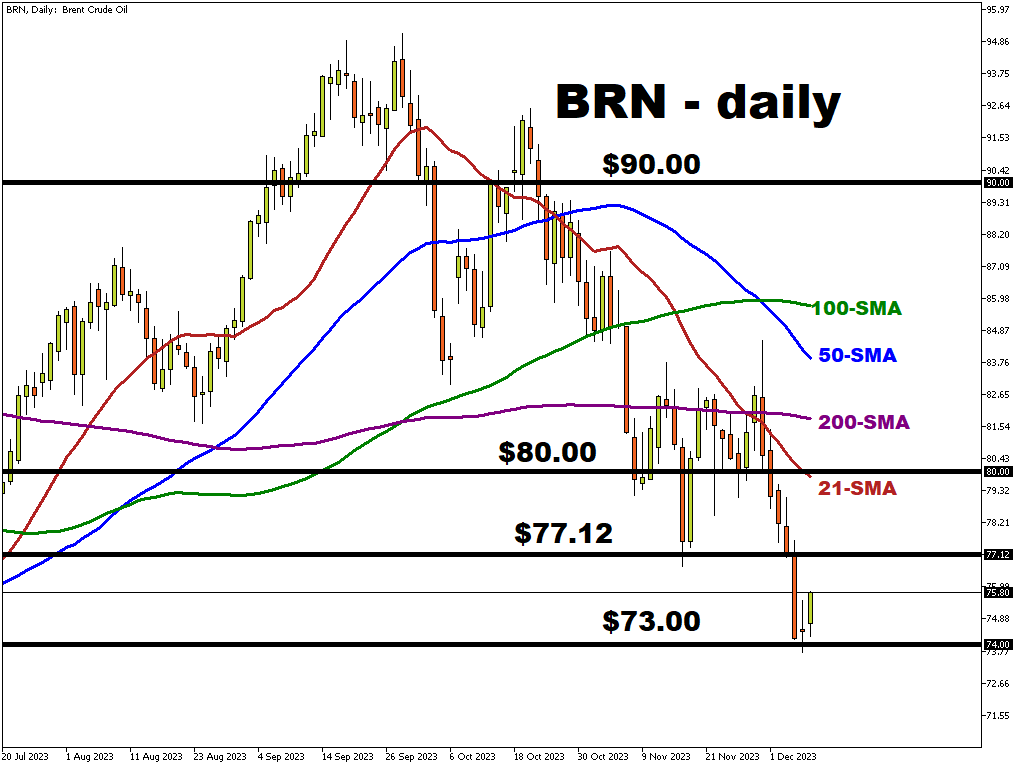

BRN is trying to rebound away from $74/bbl after a ~10.15% drop in price (30.11.2023-06.12.2023) amid market skepticism on whether the OPEC+ production cuts will be fully implemented.

Downward pressures on the demand side are also taking a toll on oil prices, primarily driven by the decline in China’s oil imports along with a US’ ramp up of it’s shale production.

Moody’s recent decision to downgrade the outlook on China’s A1 debt to “Negative” (prev. “Stable”) underlines the uncertainty surrounding economic growth in the world’s largest oil consumer.

However, both Russia’s and Saudi Arabia’s officials have indicated that the supply cuts could be further extended.

From the technical prospective…

- BRN is located significantly below 100 and 200-period SMA, indicating a potential bearish long-term trend

- To the upside, $77.12/bbl may be the next important threshold for the BRN bulls to reach for

- To the downside, $74/bbl round number might prove to be a strong support level if the BRN bears try to regain control again

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.