Daily Market Analysis and Forex News

Gold steady ahead of US jobs report

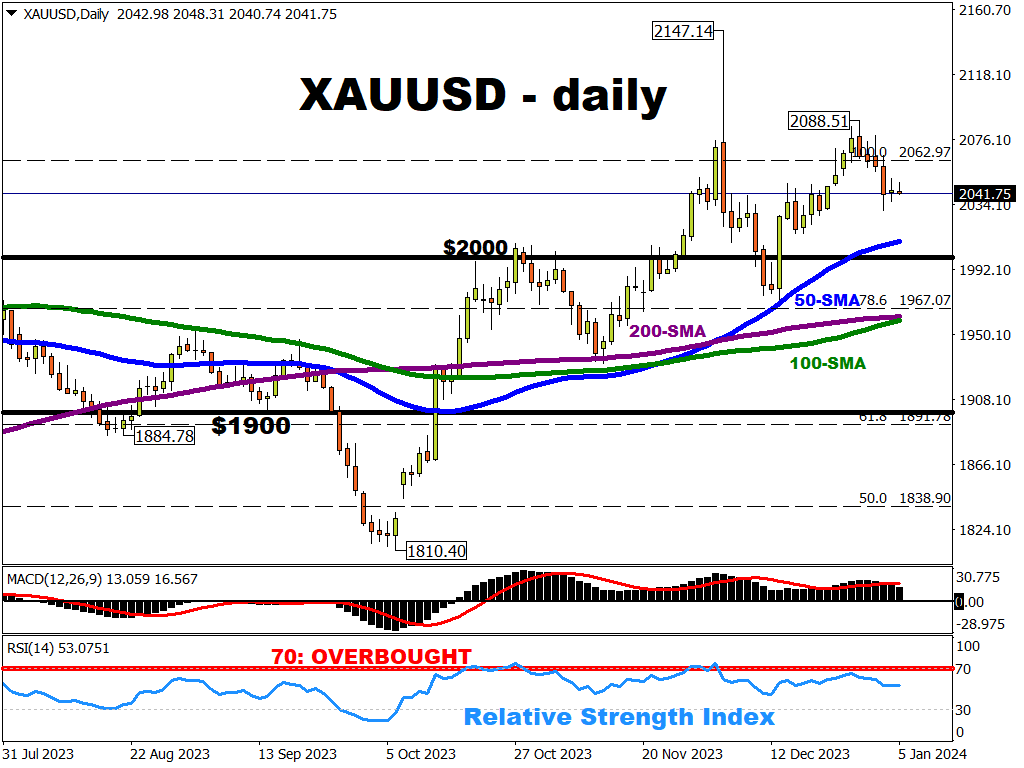

Spot gold is hovering around the $2040 mark, as markets await the incoming US nonfarm payrolls report (NFP).

Gold has pared some of its gains since mid-December, though has found a somewhat firmer footing as of yesterday, as markets dilute expectations for how swiftly the Fed will lower its benchmark rates this year.

No surprise that gold is now pausing around current levels, given that this $2040 - $2050 range has served as a resistance region (now turned support) for spot gold on multiple sessions since late-November.

NFP data may trigger gold's next move

This marquee data out of the world's largest economy is typically due on the first Friday of every month, and tends to generate a lot of excitement across global financial markets.

The numbers for new jobs created, earnings growth, and the unemployment rate would help inform the Fed on what to do with US interest rates.

Stronger-than-expected hiring/earnings may force the Fed to delay its plans for lowering its benchmark rates in 2024.

How might gold react to today's NFP?

Spot gold may charge back towards $2100 if today’s US jobs data bolsters the “soft landing” narrative, allowing the Fed to loosen its policy settings closer in line with market forecasts.

However, gold may falter towards its 50-day moving average if markets learn of faster-than-expected US wage growth that forces to Fed to delay plans for lowering its benchmark rates.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.