Daily Market Analysis and Forex News

EURUSD upticks towards 50-period SMA ahead of ECB meeting

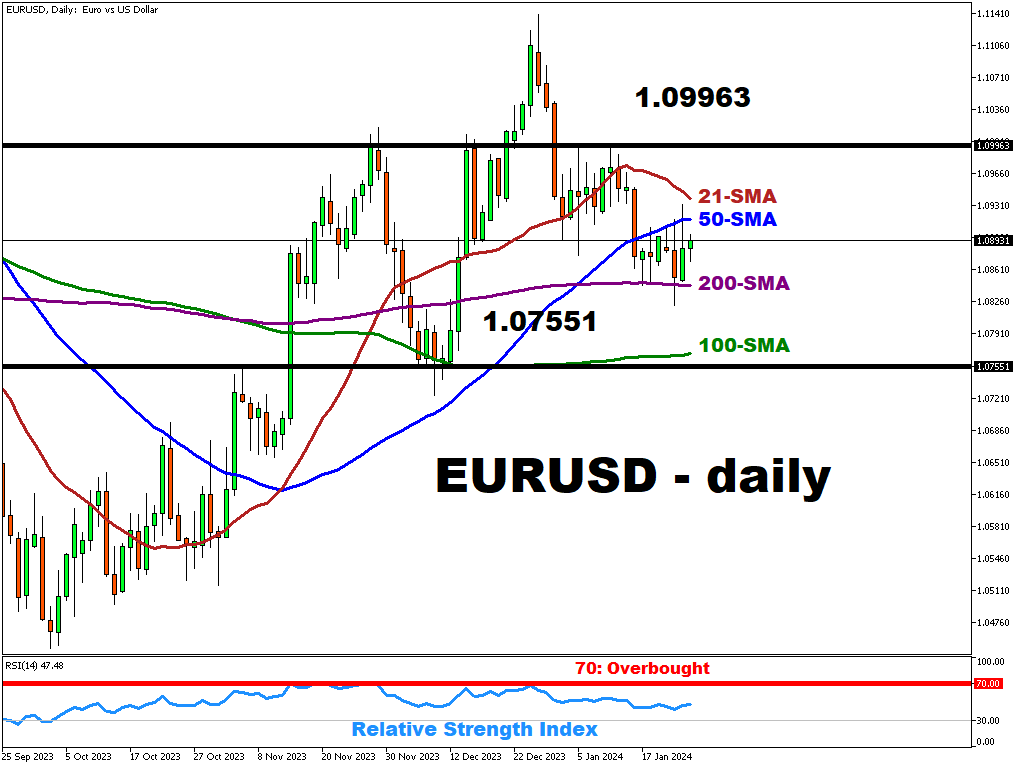

EURUSD major is experiencing a moderate uptick towards the 50-period SMA (~1.091606) ahead of the ECB’s interest rate decision scheduled for later today.

As the market seems to be quite certain that the key rate will be kept intact at 4.5%, the ECB’s commentary regarding the future policy might be the key catalyst for EURUSD price movement in the near term.

- A more dovish tone could potentially push the EURUSD towards or even below the 200-period SMA (~1.084395)

- On the contrary, the hawkish comments could propel the EURUSD pair further upwards towards the 50-period SMA (~1.091600)

US macroeconomic readings, scheduled right before the ECB press conference might also have an effect on the EURUSD or even outweigh the European central bank’s commentary.

A higher-than-expected US’ Initial Jobless Claims reading along with Q4 2023 GPD data may lower the probability for the highly anticipated interest rate cuts in March.

This could result in a EURUSD moving lower.

On the technical side …

- The key support levels are located at 200-period SMA (~1.084395), followed by the 100-period SMA (~1.076976)

- To the upside the key resistance levels are positioned at 50-period SMA (~1.091606) and 21-period SMA (1.093945)

- RSI’s positioning in the middle of the 30-70 range (>70 – overbought; <30 – oversold) underlines the current state of uncertainty as the markets position themselves ahead of ECB press conference

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.