Daily Market Analysis and Forex News

Global markets retreat amid US economic fears

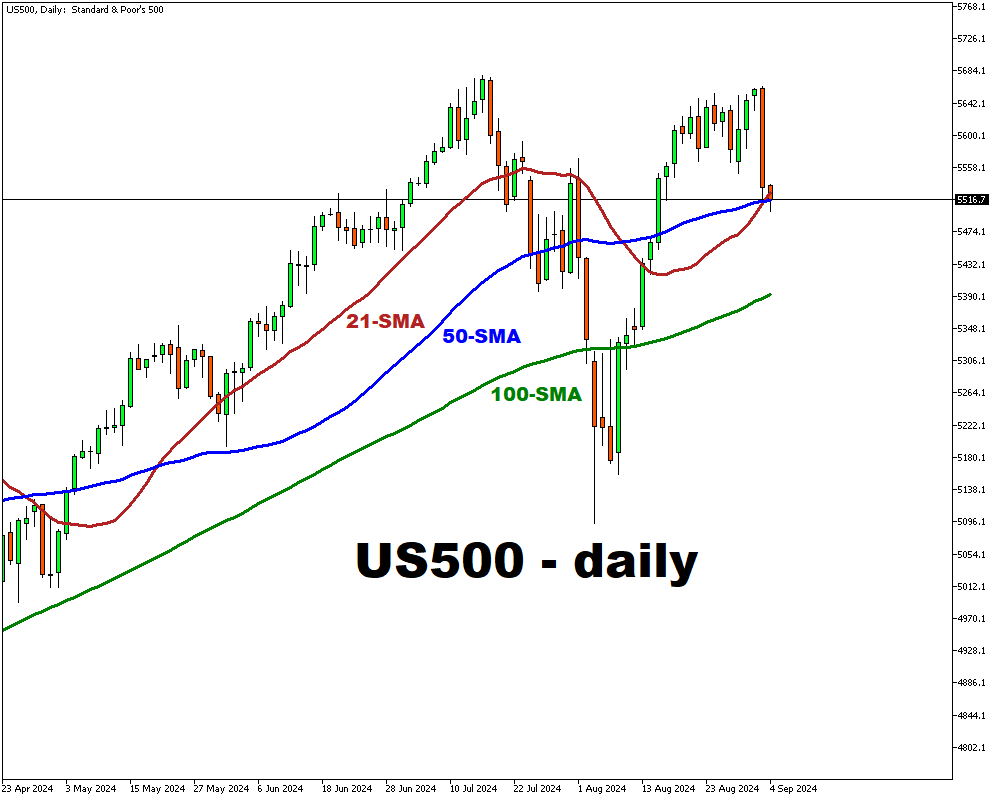

- S&P 500 dropped ~2.1%, worst since August turmoil

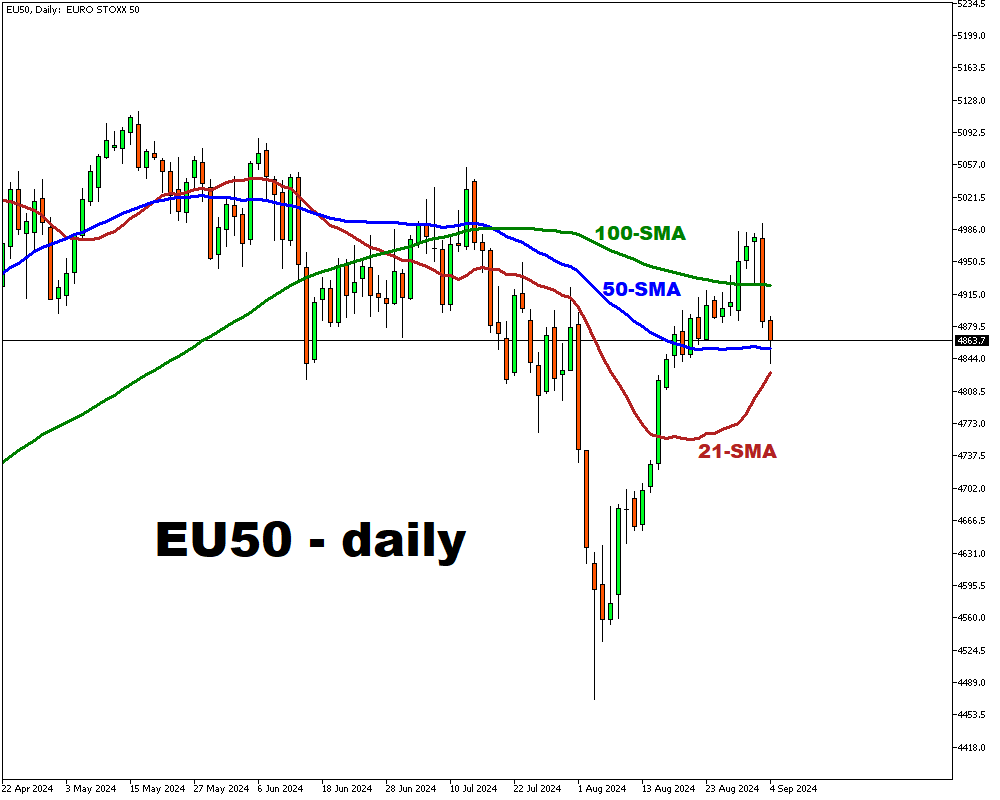

- Europe's Stoxx 50 index fell 1.2%, tech stocks hit hard

- Asian semiconductors down, Nvidia's slump impacts region

- Investors await US NFP data to gauge recession risks

Global markets retreated from risk assets, driven by growing concerns about the U.S. economy and a shift away from large-cap technology stocks, leading to a significant decline in U.S. equities.

The S&P 500 fell ~2.1% after the index posted its worst performance since the market turmoil on August 5.

Europe's Stoxx 50 index fell 1.2% in a volatile trading session, with technology companies such as ASML Holding NV among the biggest losers.

Asian semiconductor manufacturers were also down, reflecting the previous day's slump in Nvidia Corp, which contributed to a more than 2% drop in a regional equity benchmark.

Market participants are bracing for further volatility as they await key economic data that may indicate whether the U.S. is on the brink of a recession and how the Federal Reserve may adjust its monetary policy.

The Non-Farm Payrolls (NFP) report is expected to show further cooling in the labor market after manufacturing activity contracted for a fifth straight month.

As investor focus shifts from inflation to economic growth concerns, negative macroeconomic indicators are increasingly impacting stocks and other risk assets.

Traders currently expect the Federal Reserve to begin easing policy in September, with projections for a rate cut of more than two percentage points next year, the largest reduction outside of a recession since the 1980s.

Friday's payroll data is seen as critical in determining the size of the first rate cut, with the uncertainty causing investors to be cautious.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.