Daily Market Analysis and Forex News

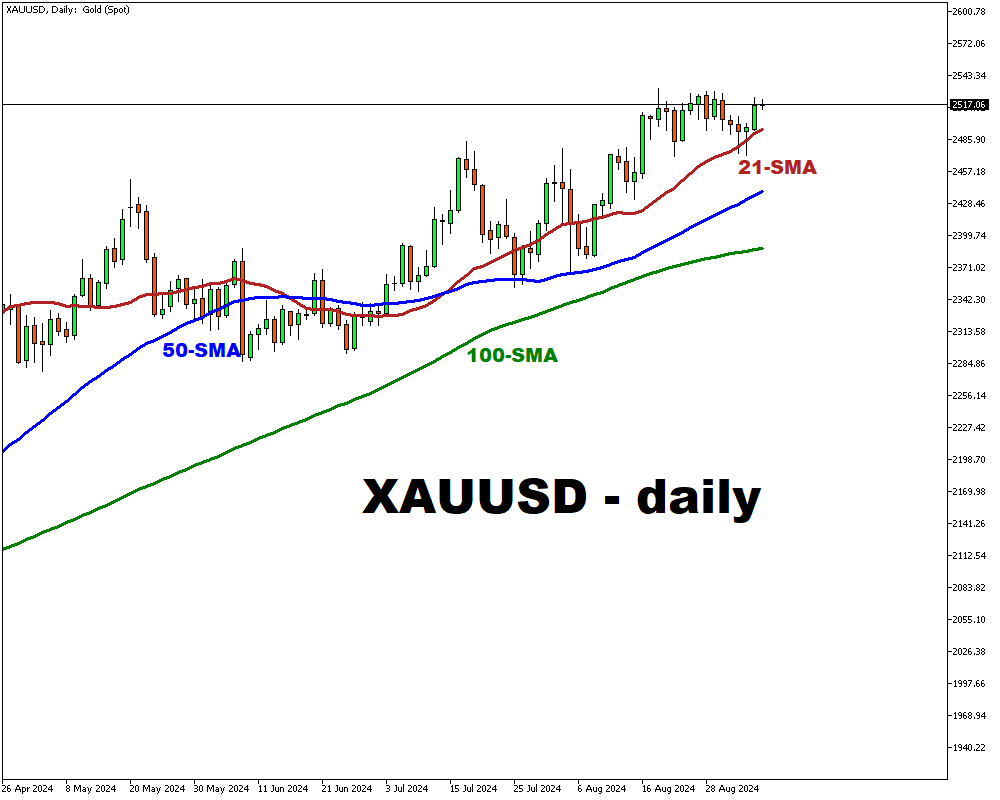

XAUUSD trades above $2,500 mark

- Gold trading above $2,500 amid dollar weakness

- 43% chance of 50-bps Fed cut in September

- Uncertainty may temper short-term price gains

- 4.3% unemployment rate could boost gold prices

- Potential for $2,700 by late 2024 with rate cuts

Gold has been experiencing a notable rise, currently trading above the psychological $2,500 mark, buoyed by a weaker US dollar following disappointing ADP and JOLTS figures.

This environment has fostered optimism among investors, particularly with a 43% chance of a 50-basis point Fed rate cut in September, which has contributed to gold's upward momentum.

However, short-term price gains may be tempered by uncertainties surrounding the Federal Reserve's policy direction, potentially leading to a gradual increase rather than a sharp ascent.

As traders await the upcoming US jobs data, expectations are high.

If the unemployment rate remains at 4.3%, it could reinforce bullish sentiment, pushing gold closer to its record highs.

Conversely, a dip to 4.2% might dampen rate cut expectations, risking a temporary retreat below $2,500.

Looking ahead, if the Fed delivers the anticipated 100-basis point cuts by the end of the year, gold could reach the $2,700 level by late 2024, solidifying its status as a safe-haven asset in uncertain economic times.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.