Daily Market Analysis and Forex News

King Dollar continues to reign

Call it whatever you like but one thing is certain …

The US dollar rally is relentless and US “exceptionalism” is powering an ongoing advance in the world’s premier reserve currency.

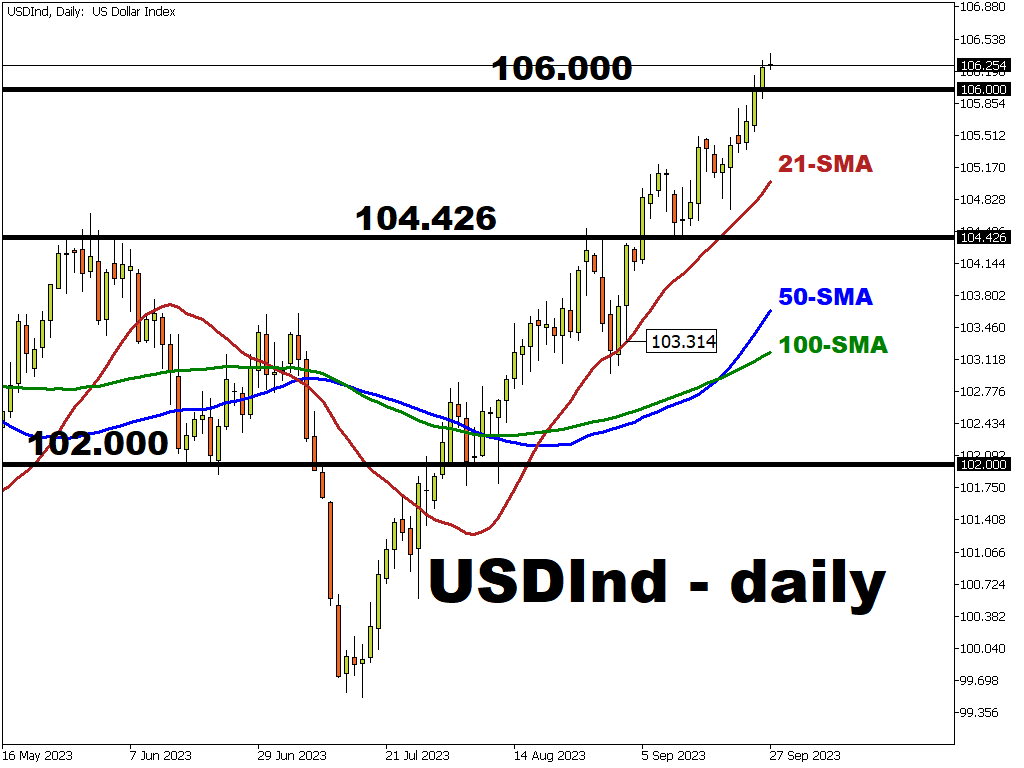

USDInd, which measures the US dollar’s performance against a basket of major currencies such as JPY, EUR, and GBP, has now soared to its highest levels since November 2022.

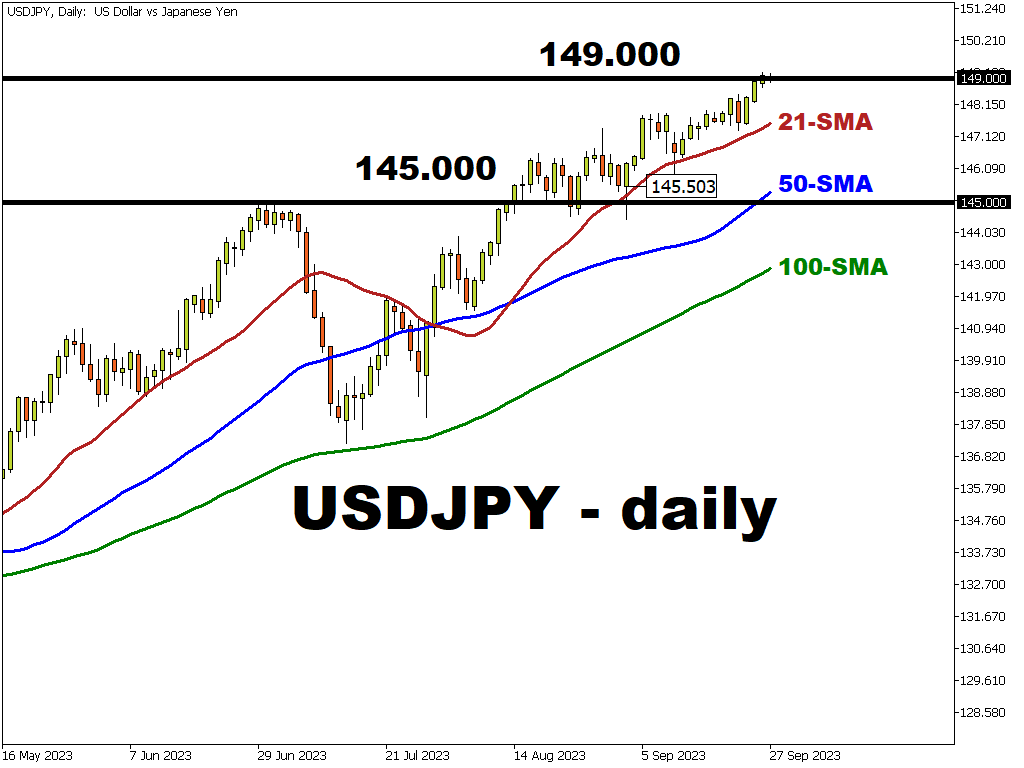

USD/JPY close to 150 and intervention zone

USD/JPY made a fresh cycle high at 149.18 yesterday but backed away from 150 as Finance Minister Suzuki weighed in on the currency.

Suzuki said he is watching FX moves with a great sense of urgency.

The Fed’s hawkish noises last week coincided with another dovish BoJ meeting a couple of days later highlighting the divergent monetary policy stances.

The major broke higher at the start of this week and it seems physical intervention from the Japanese authorities is likely not far away if the pair continues its uptrend. We note that an environment of falling growth and inflation does tend to favour the yen.

The 21-day simple moving average sits at 147.52 which is below the near-term breakout level around 148.41/46.

The other major currencies continue to get sold in this ruthless dollar rally.

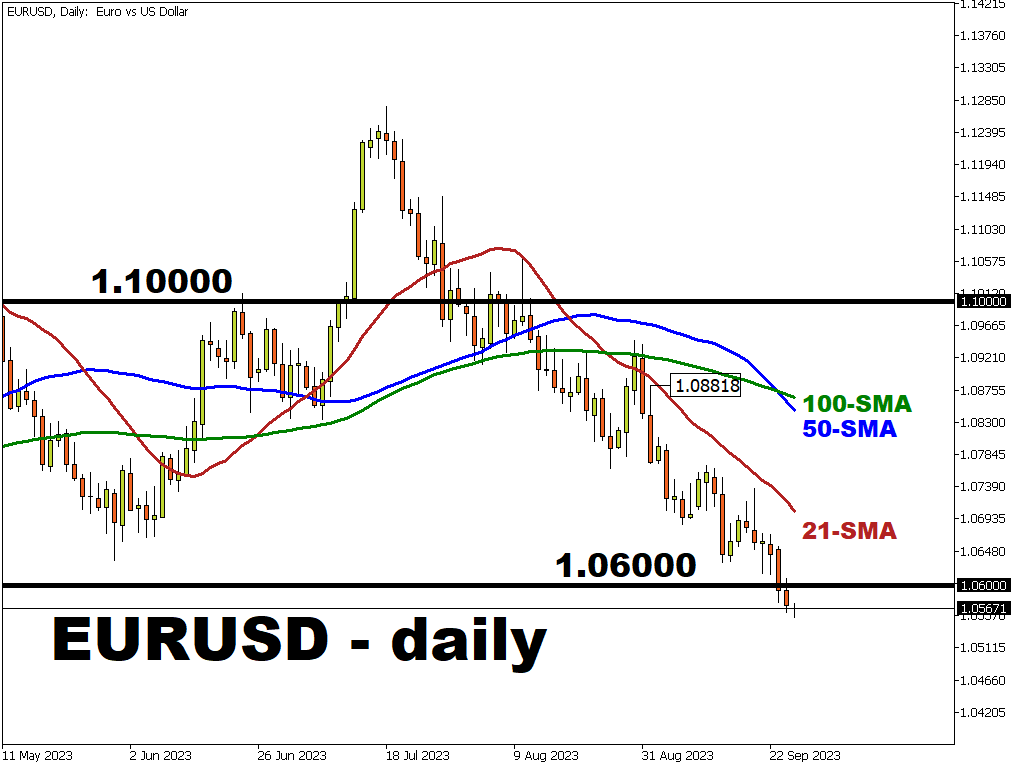

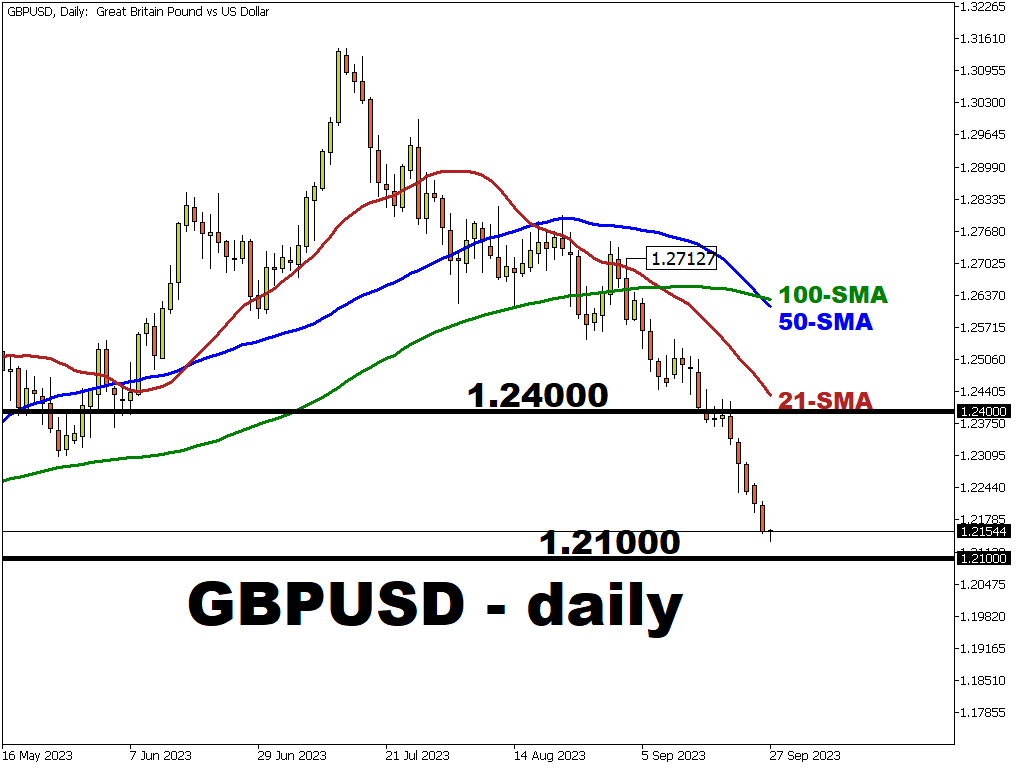

EUR and GBP continue lower

For the euro, even relatively hawkish comments from ECB President Lagarde and other officials earlier in the week have failed to arrest the downtrend.

A breakdown through key support above 1.06 means the March low is now in play at 1.0516.

GBP has also seen bearish momentum pick up since the Fed decision and the BoE standing pat last week.

The cable move certainly looks oversold on several measures but round numbers like 1.21 below look possible.

The risk of short-term strength in the buck is high given the strong bullish momentum.

But sentiment and positioning are perhaps now shifting too far, too quickly which leaves markets prone to a USD downswing if we get any type on adverse fundamental news like a series of poor data or even a US government shutdown.

The final print of US Q2 GDP data is expected at the end of this week while growth is forecast to slow in the third quarter.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.