Daily Market Analysis and Forex News

BRN struggles below 200-day SMA amid OPEC+ uncertainty

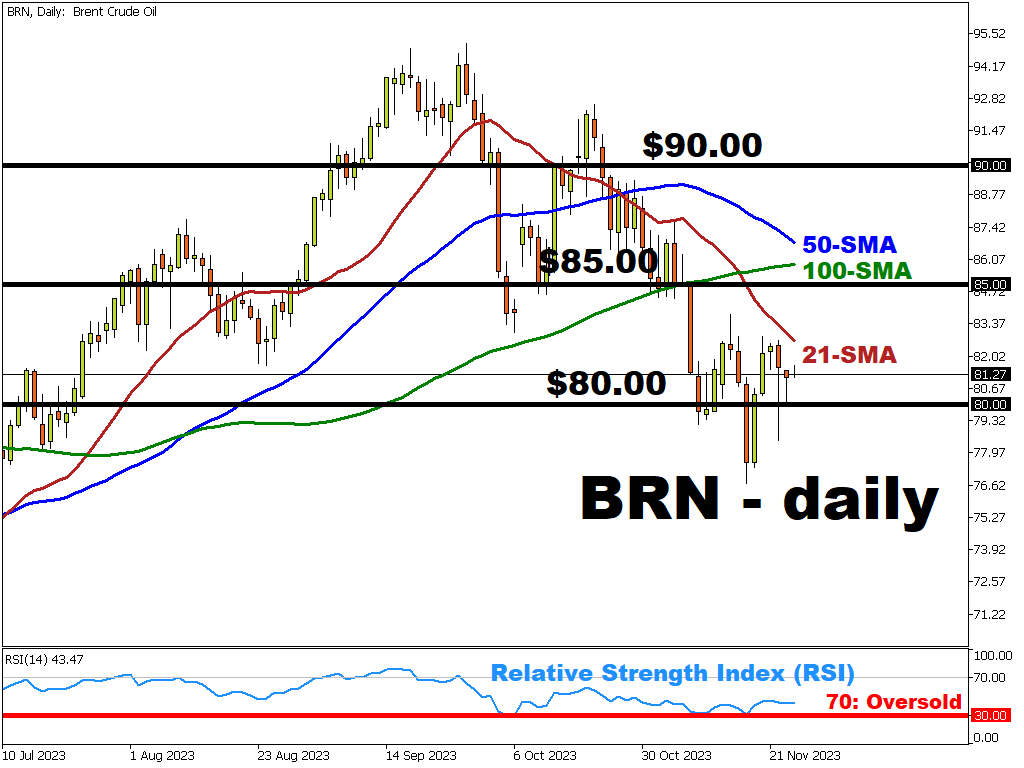

BRN bulls are trying to stabilize around $81.24/bbl after oil prices experienced a ~1% decline on Wednesday, before swiftly paring much of those knee-jerk declines.

OPEC+ will instead hold this meeting online, on November 30.

Prior to the delay, markets had leaned towards an extension of Saudi Arabia’s unilateral 1 million bbl/day production cut with the potential for other OPEC members to join them.

With the current de-escalation in the Middle East and still murky prospects for a global oil demand in 2024, BRN might be on track to seal back-to-back monthly declines.

On the supply side, the higher-than-expected (8.7M vs 1.6M expected) change in US crude oil inventories reading before Thanksgiving, along with a potential increase in supply from outside of the OPEC+ circle are adding additional downward pressure to the oil prices.

From a technical perspective…

- The Relative Strength Index (RSI) is positioned close to the middle line at 43.47 (<30 – oversold; >70 – overbought), suggesting that markets are at a crossroad as investors await further developments

- The current price, trading below all three major SMAs (21, 50 & 100-period) may count as a signal for a continuous downtrend

- The $80/bbl psychological level may prove to be a strong support level

- To the upside, the $85/bbl and 21-period SMA at $82.695 may act as immediate resistance levels

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.