Daily Market Analysis and Forex News

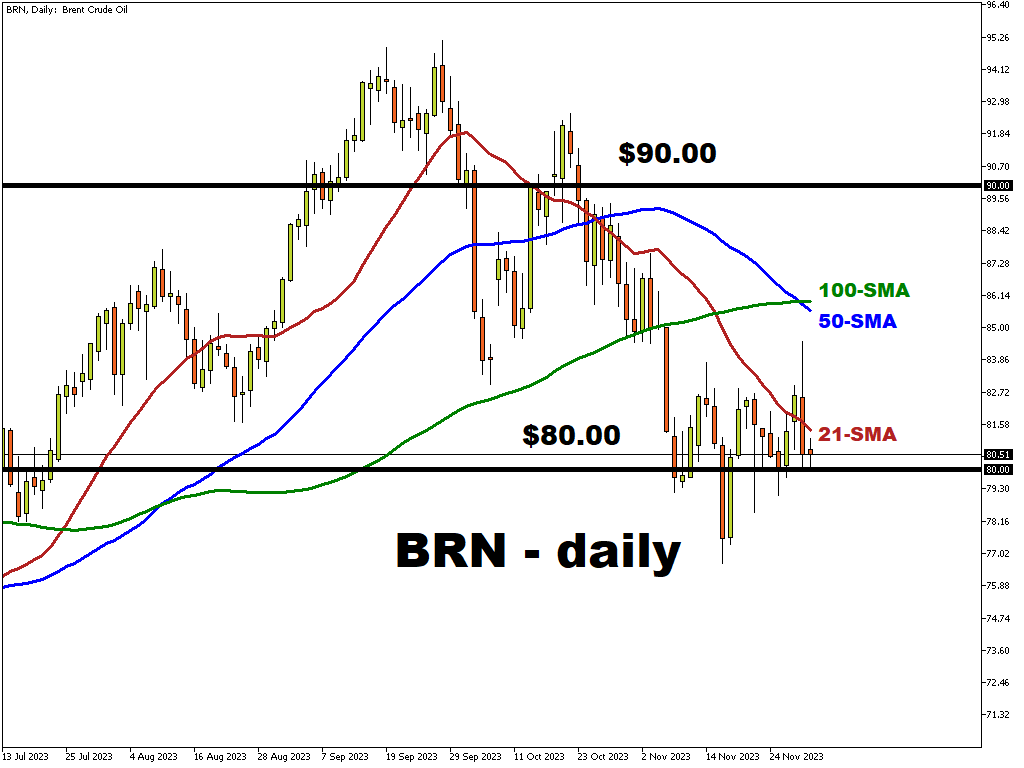

BRN is trying to stabilize above $80/bbl

BRN is trying to stabilize above the $80/bbl psychological level following the confusion sparked by the OPEC+ meeting on Wednesday.

Despite the OPEC+ announcement of it’s new 900k bbl/day supply cuts, investors have remained uncertain on whether these reductions will be fully taking place as they are being introduced on a “voluntary” basis.

Previously implemented voluntary cuts (~1.3M bbl/day), by Russia and Saudi Arabia, were also extended into Q1 2024.

Adding to the downside:

- The demand side pressures are still relevant as IEA is forecasting a slowdown in 2024 oil demand

- Angola might produce larger quantities despite it’s OPEC quota

- U.S. crude production continues to grow (+1.7% in Sep.)

However, any changes in a 2024 demand outlook or a sudden escalation in the Middle East may significantly affect oil prices.

From the technical perspective…

- 100-period SMA has moved above its shorter counterpart (50-period SMA), forming a “death cross” pattern and signaling a potential for a bearish market

- $80/bbl psychological level may set to provide an immediate support

- To the upside, the 21-period SMA (at $81.369/bbl) may act as a strong immediate resistance level

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.