Daily Market Analysis and Forex News

BRN surges above $80 amid the escalation in Yemen

Oil prices surged above 80$/bbl as escalating tensions in the Middle East stoked market anxieties.

Retaliatory US and British strikes against the Houthi military in Yemen, following the Red Sea attacks, have almost pushed brent to it’s December 2024 peak at $81.42/bbl.

The demand side concerns persist with China’s oil demand growth expected to decline to ~4% in the 1H 2024 due to ongoing turbulence in the property sector.

A potential slowdown of the European economy along with unexpected surge in US crude stockpiles (+1.3M vs -0.675M expected) further complicates the black gold’s prices to stay elevated.

However, in 2024 we may expect a steeper demand for “black gold” from the aviation and petrochemical sectors.

These would be primarily driven by post-pandemic travel recovery and an increase in manufacturing activity of solar panels & electric vehicles.

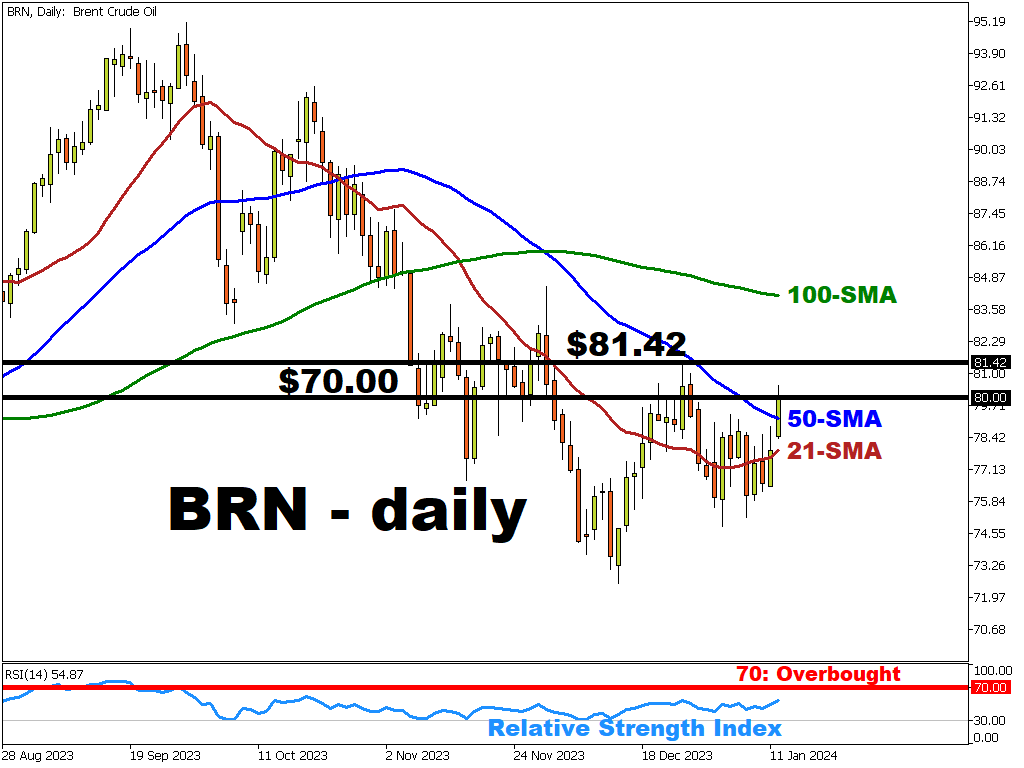

On the technical side…

- Moving above the psychologically important $80/bbl and 50-period SMA may suggest that momentum could tilt further upward in the short-term

- 50-period SMA, once support, may turn in to resistance if the geopolitical tensions ease and demand worries persist

- The December 2024 high ($81.42/bbl) remains the immediate prime target for bullish BRN traders

- Relative Strength Index (RSI) hovering at 55.87 (>70 – overbought; <30 – oversold) reflects the market’s uncertainty about the future trajectory. Yet, given the current market conditions bulls appear to have an edge, at least for now…

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.