Daily Market Analysis and Forex News

US500 index posts highest-ever closing price

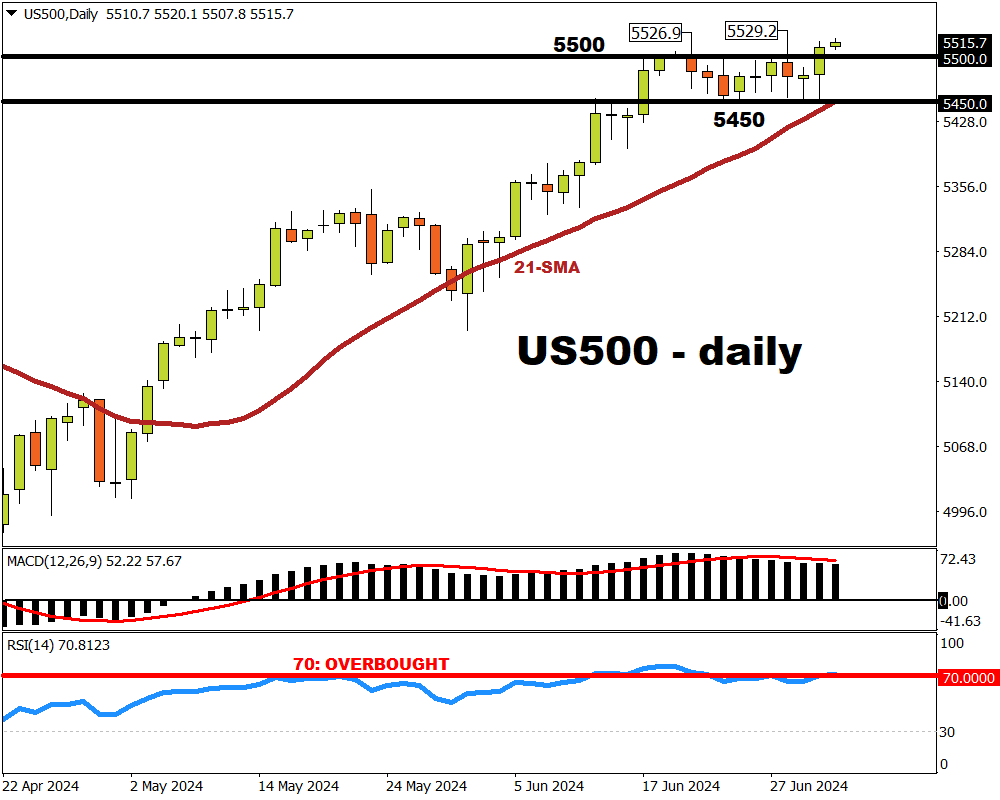

- US500 posted 32nd new record high, using closing prices, so far in 2024

- US500 still about 10 index points below highest-ever intraday price 5529.2

- US stock indexes climb on Tesla/Big Tech boost, hopes for Fed rate cuts

- Wall Street expects US500 to touch 6,000 level by mid-2025; potential 8-9% gains over 12 months

- Over past 20 years, July has seen largest monthly average climb for US500

The US500 stock index has posted its highest-ever closing price.

At the US market close on Tuesday, July 2nd, this benchmark blue-chip index closed above the 5,500 round number for the first time in its history.

And it's still adding to those gains, at the time of writing.

NOTE: The US500 tracks the benchmark S&P 500 index, which measures the overall performance of the US stock markets.

To be clear, using intraday prices instead, the US500 had previously traded at even-higher prices in the past.

The US500’s current record high, using intraday prices, currently stands at 5529.2 as posted on June 28th.

Hence, a daily close above 5530 might be the next goal for bulls (those hoping prices will move higher).

Such an accomplishment may even have the psychological effect of enticing even more buyers into the market to help push the US500 even higher.

The psychological impact from big round figures

The price action since mid-June is just the latest example of how whole round numbers (e.g. 5500) can exert strong psychological impact on traders.

In other words, big round numbers tend to exert strong “gravitational pull” on prices.

Such a “gravitational pull” was seen for the past two weeks, markets struggled to justify moving the US500 well above or below this psychological level of 5500.

Why did US stock markets jump higher?

1) Tesla’s better-than-expected deliveries

Tesla’s stocks jumped 10.2% yesterday (Tuesday) after reporting a higher-than-expected 443,956 vehicles in Q2 2024.

Given Tesla’s weight as one of the 10-biggest stocks within the US stock index ‘basket”, its surge also helped propel the US500 index (as well as other Big Tech stocks like Apple, Amazon, and Alphabet).

2) Higher hopes for Fed rate cuts

Also on Tuesday, Fed Chair Jerome Powell offered comments suggesting that US inflation is indeed cooling down (disinflation).

As inflation subsides, this could pave the way for the Federal Reserve – the most important central bank in the world – to start lowering US interest rates.

Markets raised their bets for a Fed rate cut in September 2024 from 70% on Monday (July 1st), to 73% on Tuesday (July 2nd).

And that was enough to help propel the US500 to its highest-ever closing price.

How much higher can the US500 go?

According to Wall Street analysts, the US500 is expected to flirt with the 6,000 level by this time next year.

Such forecasts imply further gains of about 8.8% over the next 12 months.

Also, there are seasonality factors that could help boost the US500 index.

Over the past 20 years, the month of July has seen the largest average monthly gain for the US500, compared to all other months in the calendar year.

Since 2004, the US500 posts an average gain of about 2.3% for the whole month of July.

If this seasonal trend proves true once more, coupled with fundamental factors that favour more upside, then the US500 may well post new record highs over the course of July 2024.

What to look out for?

- July 5th: US nonfarm payrolls (jobs report)

Weakness in the US jobs market could further hasten Fed rate cuts and further boost the US500.

- July 11th: US consumer price index (CPI)

Further US disinflation (slowing inflation) could see the Fed warming up to the idea of rate cuts – an idea that’s likely to encourage the US500 to move even higher.

- July 12th: US earnings season begins

The quarterly earnings announcement by JPMorgan, the biggest US bank, is widely seen as the unofficial kick-off to the US earnings season. The US500 may push even higher if many big US stocks announce better-than-expected earnings in Q2 2024, while stoking optimism of even greater earnings ahead.

- July 31st: Fed rate decision

Although markets currently believe that this next FOMC policy meeting is still too soon for a US rate cut, Fed Chair Jerome Powell is set to convey further clues on the timing of the highly-anticipated policy pivot.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.