Daily Market Analysis and Forex News

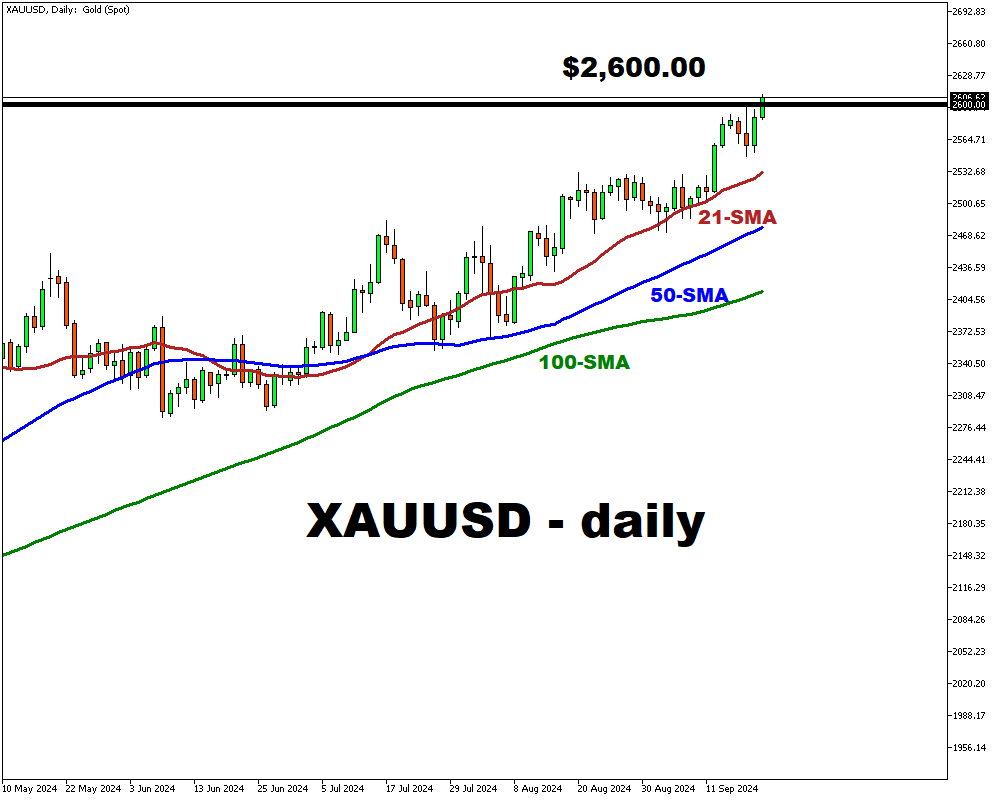

XAUUSD surges past $2,600 following Fed rate cut and geopolitical turmoil

- Gold surpasses $2,600 per ounce record high

- Fed cuts interest rates by 50 basis points

- Further rate cuts expected by year-end

- Escalating Middle East tensions raise concerns

On Friday, gold prices surged past $2,600 per ounce, achieving a new all-time high as investors evaluated monetary policy shifts from key central banks, driven by increasing geopolitical tensions that heightened demand for safe-haven assets.

The Federal Reserve made a significant move by cutting interest rates for the first time since early 2020, implementing an unexpected reduction of 50 basis points.

Fed officials indicated that the benchmark rate might decrease by an additional half percentage point by the end of the year, enhancing gold's attractiveness by reducing the opportunity cost associated with holding non-yielding assets.

In contrast, the People's Bank of China opted to keep its benchmark lending rates steady, while both the Bank of England and the Bank of Japan maintained their current policy rates.

Additionally, gold's status as a safe haven was reinforced by escalating conflicts in the Middle East, raising fears of a wider confrontation.

With these developments, bullish sentiment around gold may persist, potentially driving prices even higher amid ongoing geopolitical and economic uncertainties.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.