Daily Market Analysis and Forex News

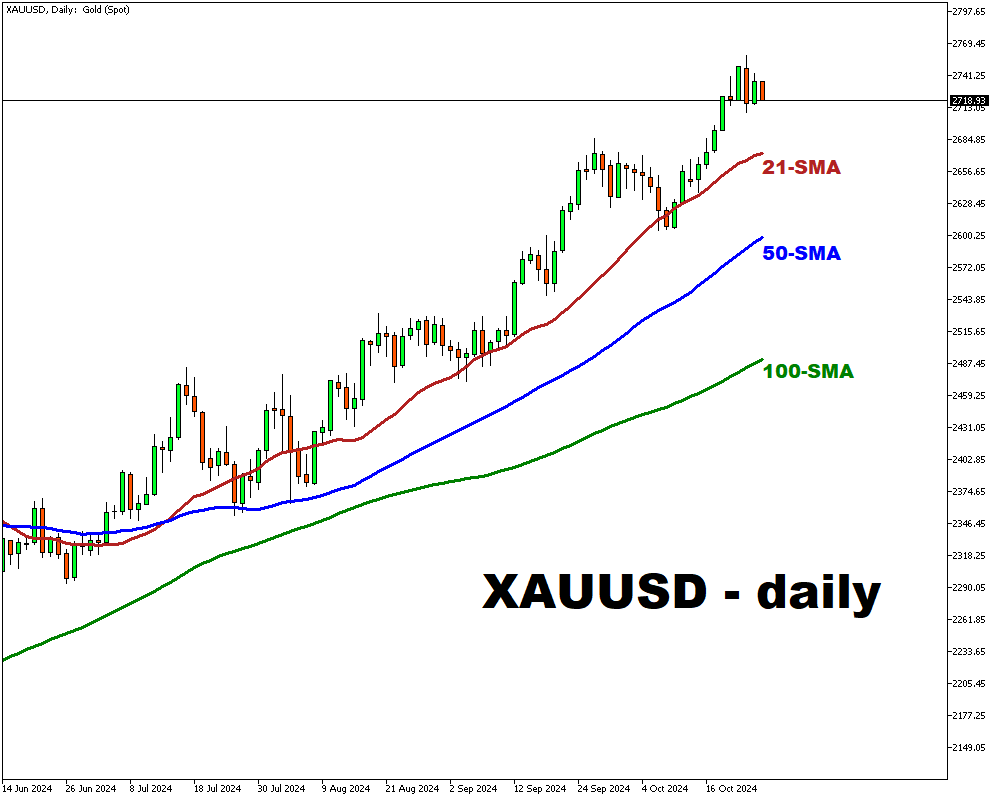

Gold stays resilient above $2,700 level

- Gold stays strong above $2,700 despite pullback

- Focus on Fed rate cuts and US election risks

- Prices dipped below $2,730 due to dollar strength

- Geopolitical tensions support gold's upward trend

Gold bulls continue to keep the gold prices above the crucial $2,700 mark.

The focus for precious metals remains on the anticipated pace of Federal Reserve interest rate reductions, potential risks associated with the upcoming US elections, and ongoing geopolitical unrest.

The recent surge in gold prices can be attributed to sustained demand for safe-haven assets and expectations for further Fed rate cuts.

Markets remain cautious about election-related uncertainties and persistent geopolitical tensions in the Middle East, provided that bullion can withstand the recent uptick in US treasury yields and the dollar.

On Friday, gold prices dipped below $2,730 per ounce after a previous increase, as the robust US dollar and rising treasury yields diminished the metal's appeal as a safe haven.

This change followed strong US economic indicators that suggested the Federal Reserve may adopt a less aggressive approach to rate cuts than previously anticipated.

Recent data indicated a significant drop in US unemployment claims, reflecting a strong labor market, while an increase in the S&P PMI signaled robust private sector activity.

Nonetheless, geopolitical tensions and election uncertainties continue to support gold's upward trajectory.

آماده معامله با پول واقعی هستید؟

باز کردن حسابGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.