Daily Market Analysis and Forex News

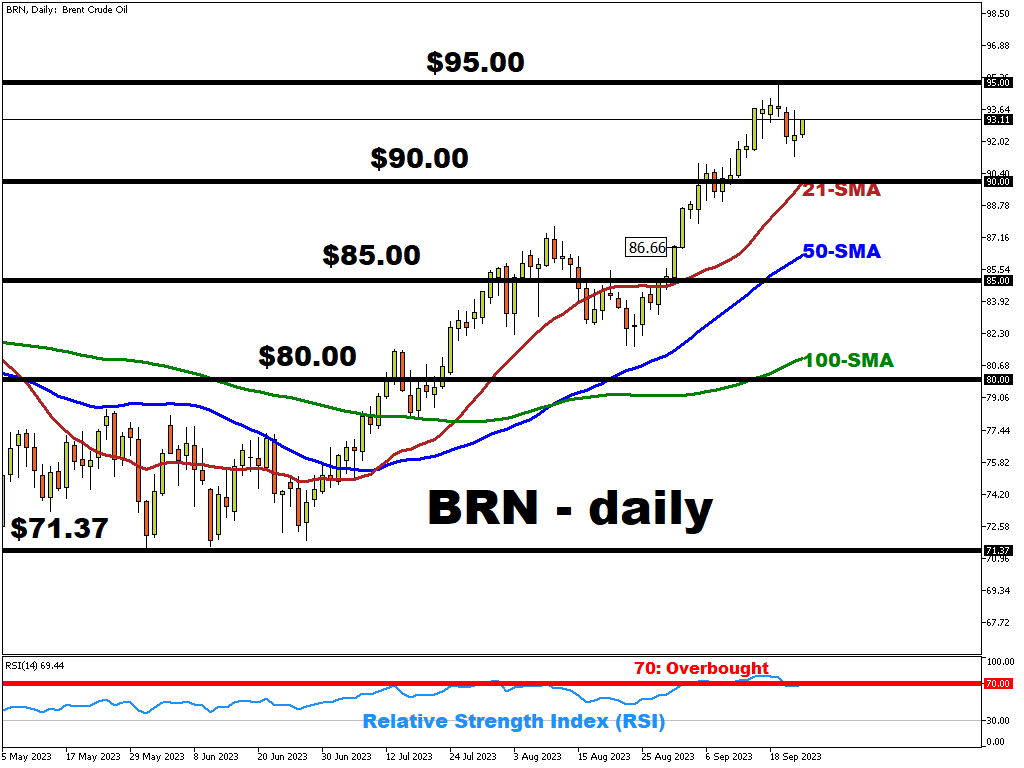

BRN bulls retreat from 2023 high ($94.89)

After briefly reaching 2023 high at $94.89/bbl earlier this week, oil prices came under pressure as the Fed hinted on a possibility of one more rate hike by end-2023.

Further policy tightening may cause an economic slowdown, potentially resulting in a lower fuel demand.

A larger (-2.135M) than expected (-1.200M) drop in US crude inventories was not able to extend enough support to the BRN bulls as all eyes were pinned towards Fed’s hawkish remarks.

However, oil prices may persist at high levels in the near future as the result of Saudi Arabia and Russia's decision to extend their voluntary production cuts until the end of this year.

Saudi Arabia has also hinted on the possibility of extending its production cap in to 2024.

The market expects a 2.0 million & 1.1 million bbl/day deficit in Q3 and Q4 respectively.

Russia’s unexpected temporary ban on fuel exports introduced yesterday (Thursday, September 21st) may also extend support to the BRN bulls, trying to regain upward momentum.

Institutional investors anticipate even higher oil prices and have managed to push net total long position in BRN & WTI up to 527,000 contracts (as of September 12).

From a technical perspective a consolidation pattern may form in $90-$95 range as investors grasp for macro-economic clues on US & China’s economies (world’s largest oil consumers).

The relative strength index (RSI) indicator is positioned at 69.18 (>70 – overbought; <30 – oversold), signalling for a potential technical pullback.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.