Daily Market Analysis and Forex News

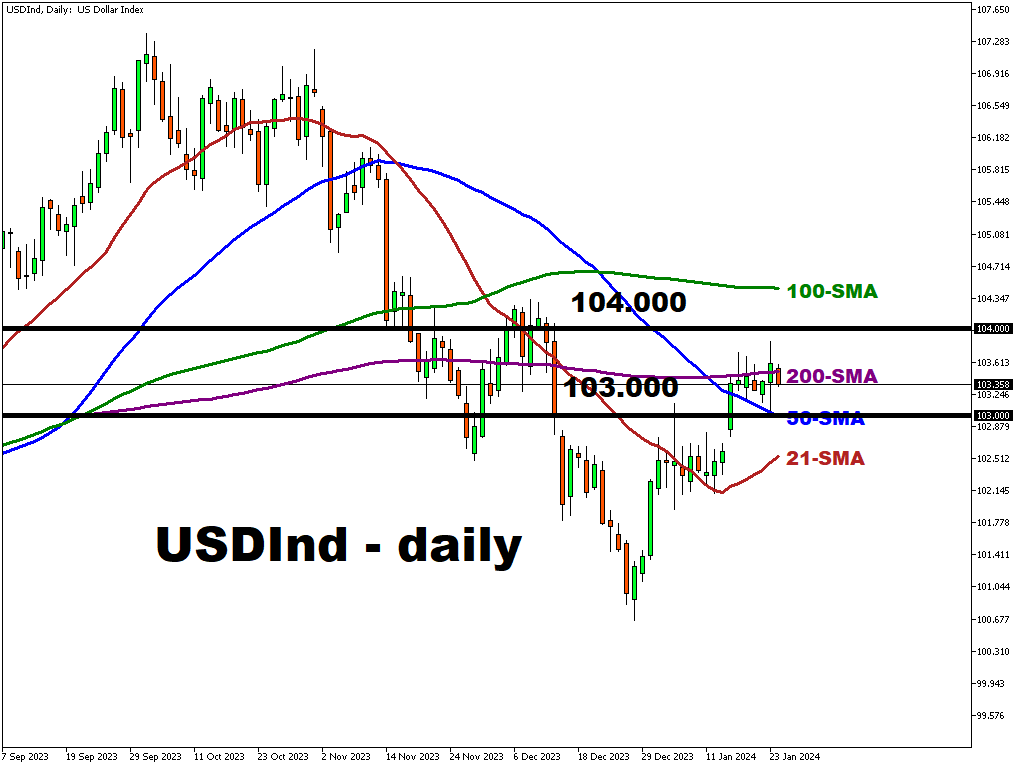

USDInd slips below 200-SMA ahead of US PMI reading

The dollar tried to move decisively to the upside yesterday after recent consolidation just below the 200-day simple moving average at 103.48 on the Dollar Index.

Treasury yields have been a big driver of price action this year as markets rein in the aggressive rate cuts which had been priced into bonds at the back end of last year.

Markets will have one eye on PMI data later today, as well as the Q4 GDP data released tomorrow.

Consensus sees around trend growth of 1.9% after the blockbuster 4.9% in Q3.

The resilient labour market is supporting the consumer, though slack is building and likely to push growth below trend in 2024.

It is notable that consensus will probably have underestimated momentum in the US economy for the sixth consecutive quarter.

Forecasters have come into each quarter over this period expecting either contractions or very soft growth, only to spend the whole quarter revising up their forecasts.

This means the dollar could see more upside after the data if it comes in well above the estimate.

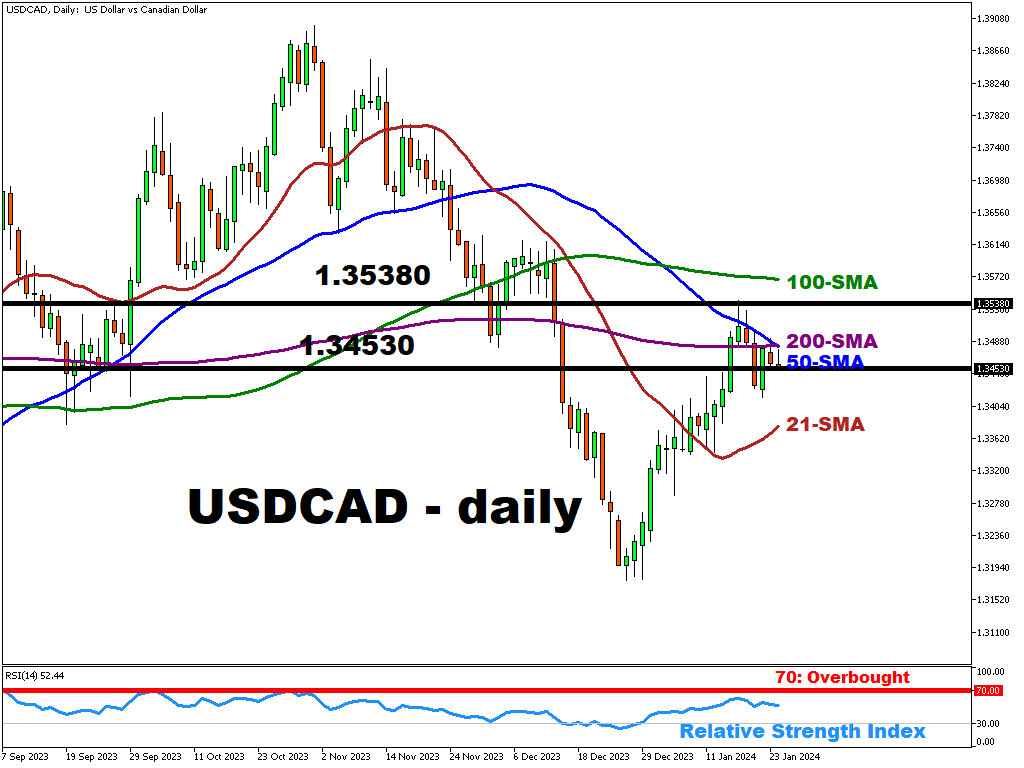

Too early for the Bank of Canada to pivot …

The BoC is fully expected to keep rates unchanged at 5%.

The economy is showing signs of weakness, but two measures of inflation ticked up in December so remain sticky.

That means it would probably be rather surprising to hear Governor Macklem sound dovish.

Caution will likely prevail with markets looking for any signals on how long the bank expects to hold rates at current levels.

USD/CAD is trading marginally under its 50-day and 200-day SMA at 1.3480/1.

Resistance above is the halfway point of the November drop at 1.3538. Supports sits at the 38.2% Fib level of that move at 1.3453.

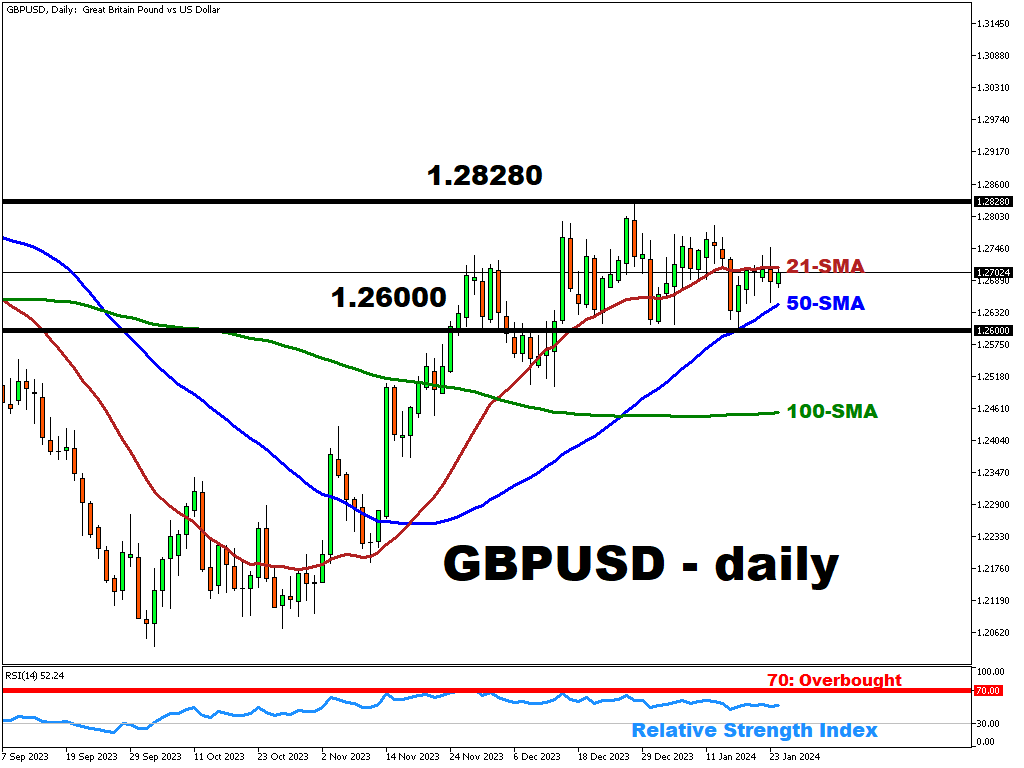

EUR, GBP to watch PMIs and where economies are heading …

Today’s PMI surveys are good gauges for how economies are faring and a leading indicator for the months ahead.

Economic activity in the eurozone remains grim, though there are hopes that manufacturing is bottoming out.

Its PMI has been below 50 for a year and a half which means contraction in the economy, while the services sector has moved sideways over the last couple of months.

Economists will focus particularly on the inflation outlook and prices paid elements.

Expectations are for a rise in UK PMIs, though the manufacturing sector remains subdued and below the boom/bust level of 50.

Lower borrowing costs and the March budget may give a lift to the figures. But supply disruptions in the Red Sea rather than improved demand could affect the manufacturing print.

GBP remains in a 1.26 to 1.2828 range. Support for the pound has come from the paring of rate cut bets, which now predict less than 100bps this year.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.