Daily Market Analysis and Forex News

This Week: GBPUSD consolidates ahead of US and UK CPI releases

FX traders will be gripped with an inflation obsession this week, as key CPI readings will be delivered out of the US and UK.

Inflation is currently the most important data that will inform the Federal Reserve (Fed) and the Bank of England (BOE) about their respective interest rate adjustments.

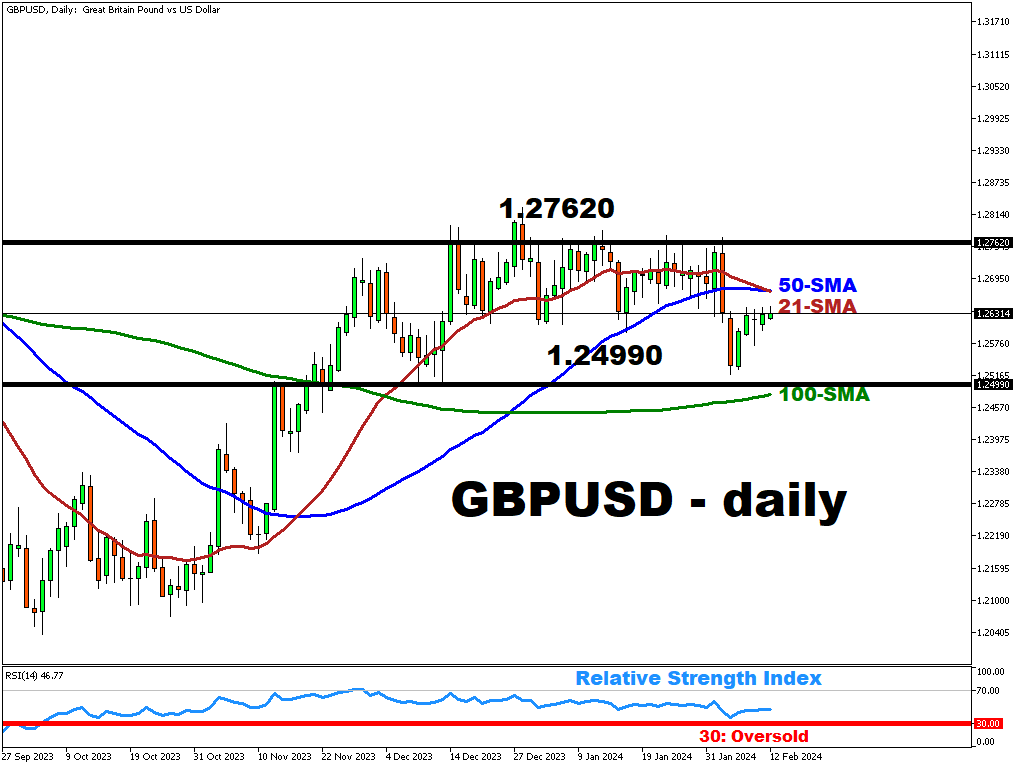

Bloomberg’s FX model now shows a 74% chance that GBPUSD will trade between 1.2499 and 1.2762 this week.

Markets are set to push higher the currency of the economy that posts higher-than-expected inflation figures which prevents its central bank from cutting interest rates soon.

Events Watchlist:

-

Tuesday, February 13th: US January consumer price index (CPI)

Economists are forecasting that these CPI prints will moderate lower in January compared to December, with the headline CPI year-on-year print expected to fall below the 3% mark for the first time since March 2021.

Higher-than-expected CPI numbers may bolster the US dollar while dragging GBPUSD below its 200-day SMA.

-

Wednesday, February 14th: UK January consumer price index (CPI)

Economists predict that the UK’s headline inflation data will tick back higher to 4.2% in January, compared to December’s 4.0% year-on-year number.

Higher-than-expected CPI figures could complicate plans for the BOE’s hopes for lowering interest rates, though could boost GBPUSD upwards and closer to its 50-day SMA.

To be clear, this UK CPI release will be sandwiched by Tuesday’s UK jobs data, its 4Q GDP and December industrial figures on Thursday, and Friday’s retail sales data.

Traders will be ready to react to every single piece of major economic data as it pertains to the BOE’s plans for interest rates in 2024 and beyond.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, February 12

- EUR: Speech by ECB chief economist Philip Lane

- GBP: Speech by BOE Governor Andrew Bailey

Tuesday, February 13

- JPY: Japan January PPI

- AUD: Australia February consumer confidence

- EUR: Germany February ZEW survey expectations

- GBP: UK jobs report

- USD: US January CPI

- Coca-Cola earnings

Wednesday, February 14

- EUR: Eurozone 4Q GDP, December industrial production

- GBP: UK January CPI

- USD: Speeches by Chicago Fed President Austan Goolsbee, Fed Vice Chair for Supervision Michael Barr

Thursday, February 15

- JPY: Japan 4Q GDP

- AUD: Australia January unemployment

- GBP: UK 4Q GDP, December industrial production

- USD: US weekly initial jobless claims; January retail sales and industrial production; speech by Atlanta Fed President Raphael Bostic

Friday, February 16

- NZD: New Zealand January manufacturing PMI; speech by RBNZ Governor Adrian Orr

- GBP: UK January retail sales

- USD: US January PPI; February consumer sentiment; speech by San Francisco Fed President Mary Daly

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.