Daily Market Analysis and Forex News

Brent bulls try to recover following a sharp decline below $73/bbl

- Brent prices hit yearly lows due to OPEC+ plans

- Weak Chinese data adds pressure on oil prices

- Libyan factions may restart oil production soon

- US summer driving season ends, affecting demand

- Technical indicators show a bearish market trend

Brent bulls continue to recover moderately after a unique combination of factors pushed oil prices lower.

Brent crude oil prices plummeted to their lowest levels of the year following reports that OPEC+ was planning to ease production cuts.

Although prices briefly rebounded to around $74 on speculation that OPEC+ may reconsider its plan, several unrelated factors are contributing to the decline:

- Weakening Chinese economic data

- A potential deal between rival Libyan factions to restart production

- The end of the US summer driving season

OPEC+ announced in June that it would restore 2.2 million barrels per day over a year starting in October but stressed that adjustments could be made along the way.

From a technical perspective...

BRN is trading below key simple moving averages (SMAs), underscoring a prevailing bearish bias in the medium- and long-term.

The Relative Strength Index is trending lower but still above its lower threshold (<30 - oversold; >70 - overbought).

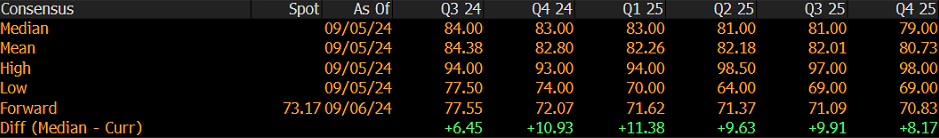

According to the Bloomberg consensus, Brent could average $82.80 in Q4 2024.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.