Daily Market Analysis and Forex News

This Week: FX trillions await central bank trio

- Dollar weakening on bets of 50-bps Fed rate cut

- Sterling set to remain as G10 leader as BOE holds

- USDJPY flirts with 140 ahead of Friday's BoJ decision

This coming week will see a central bank bonanza.

The Federal Reserve (Fed), Bank of England (BOE), and Bank of Japan (BoJ) all in action within the span of 36 hours.

No surprise that the implied volatility for the likes of USDJPY and GBPUSD are pushing higher ahead of such a pivotal week.

Much focus will be on the Federal Reserve – the world’s most influential central bank – and its policy outlook is set to reverberate across assets worldwide.

Events Watchlist:

-

Wednesday, September 18th: Federal Reserve (Fed) rate decision

The Fed is roundly expected to lower its benchmark rates for the first time since 2020.

While a 25-basis point cut appears more likely, markets are still predicting a 62% chance of a larger 50-bps cut instead.

If the Fed does shock markets with that jumbo-sized option, that could sink the dollar index (USDInd) to the 100.00 level.

The US dollar index (USDInd) is already reverting towards its year-to-date lows, now trading back below the psychological 101 level, which in turn is offering notable relief across the rest of the FX universe.

Note also that markets currently forecast 100-basis points in Fed rate cuts by Christmas (including September’s 25-bps cut).

Furthermore, there's now a 79% chance that we’ll see 125-bps in total rate cuts (a 50-basis point cut at each of the remaining 2 FOMC meetings) this year.

Major shifts to those odds would rock various assets: gold, stocks, FX, bonds, even crypto.

-

Thursday, September 19th: Bank of England (BOE) rate decision

Unlike the Fed, the BOE is widely expected to keep its benchmark rates untouched at this meeting.

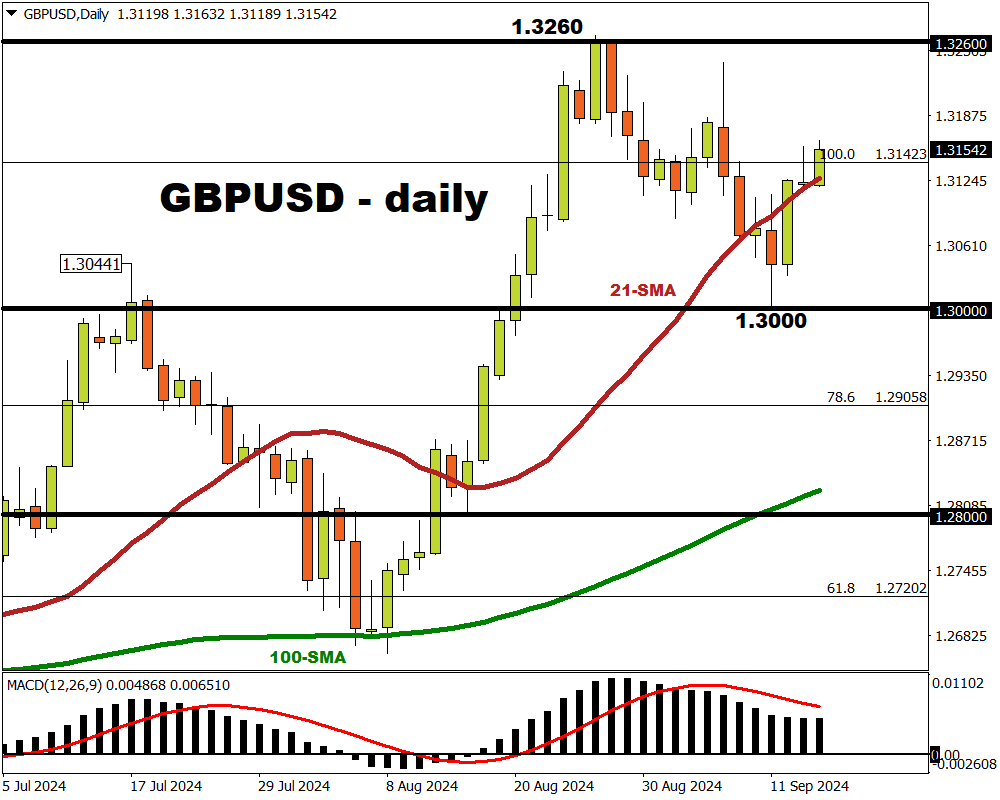

This relatively slower pace of BOE rate cuts versus the Fed’s has kept the British Pound as the best-performing G10 currency against the US dollar so far in 2024 (GBPUSD +3.3% year-to-date).

With the BOE’s bank rate maintained at 5%, more focus may be on the central bank’s quantitative tightening plans instead.

Overall, if the BOE’s plans to “normalise” its policy settings appear to be at a slower pace relative to the Fed, that could push GBPUSD towards the upper end of its 1.300 – 1.330 forecasted trading range for the week.

-

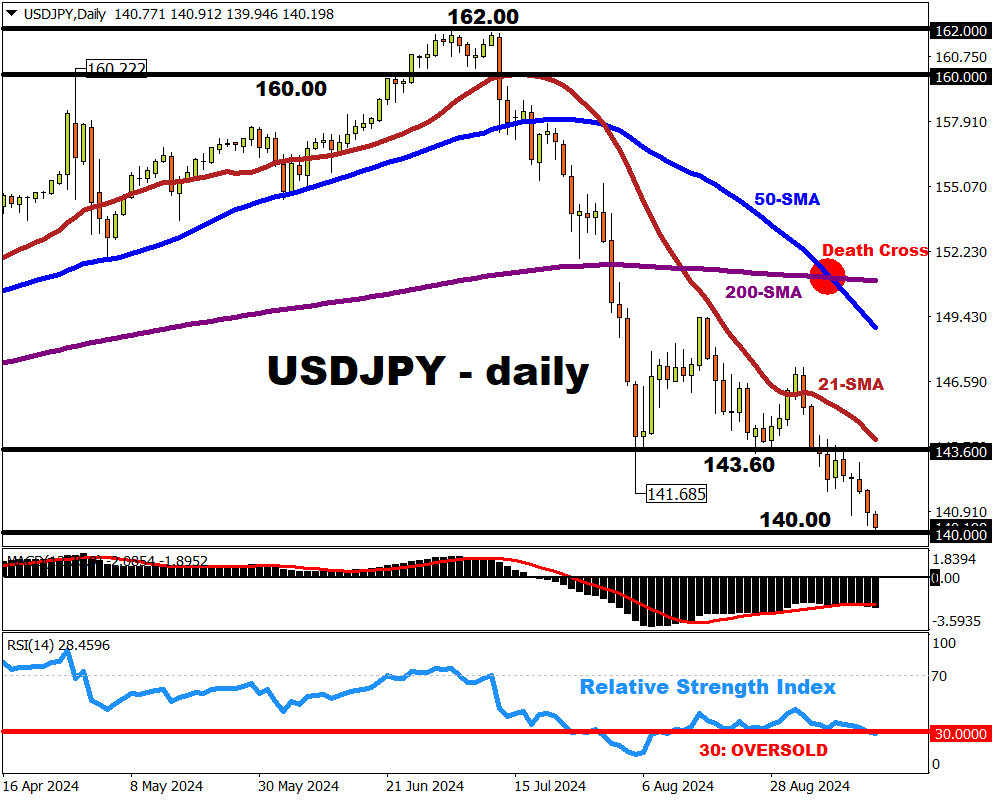

Friday, September 20th: Bank of Japan (BoJ) rate decision; August national CPI

Similar to the BOE, the BoJ is not expected to adjust its benchmark rate at this meeting.

However, shortly before the BoJ’s decision, Japan’s national CPI is due to be released and is forecasted to tick up higher to 3% in August.

Should BoJ Governor Kazuo Ueda lend his weight to recently hawkish commentary from other BoJ officials recently, especially if Friday’s national CPI exceeds expectations, that could push USDJPY towards the lower end of its 136.91 - 143.26 forecasted trading range for this week.

At the time of writing, USDJPY is already testing the 140 psychological level for immediate support, reaching its lowest levels since July 2023.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, September 16

- CAD: Canada August existing home sales

- USD: US September manufacturing

Tuesday, September 17

- SG20 index: Singapore August trade

- EUR: Germany September ZEW survey expectations

- CAD: Canada August CPI

- RUS2000 index: US August retail sales, industrial production

Wednesday, September 18

- JP225 index: Japan August trade balance

- EU50 index: Eurozone August CPI (final)

- UK100 index: UK August CPI

- USD index: FOMC rate decision

- CAD: Bank of Canada summary of deliberations

Thursday, September 19

- NZD: New Zealand 2Q GDP

- AUD: Australia August unemployment rate

- TWN index: Taiwan rate decision

- NOK: Norway rate decision

- GBP: Bank of England rate decision

- US500 index: US weekly initial jobless claims

Friday, September 20

- JPY: Bank of Japan rate decision; Japan August national CPI

- CNH: China loan prime rates

- EU50 index: Eurozone September consumer confidence; Germany August PPI

- UK100 index: UK august retail sales

- CAD: Canada July retail sales

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.