Daily Market Analysis and Forex News

Bitcoin below $60k ahead of key Fed decision

- Over past year Fed decision triggered moves of ↑ 3.4% & ↓ 2.5%

- Markets see 70% probability of a 50-basis point cut

- Watch out for US retail sales on Tuesday afternoon

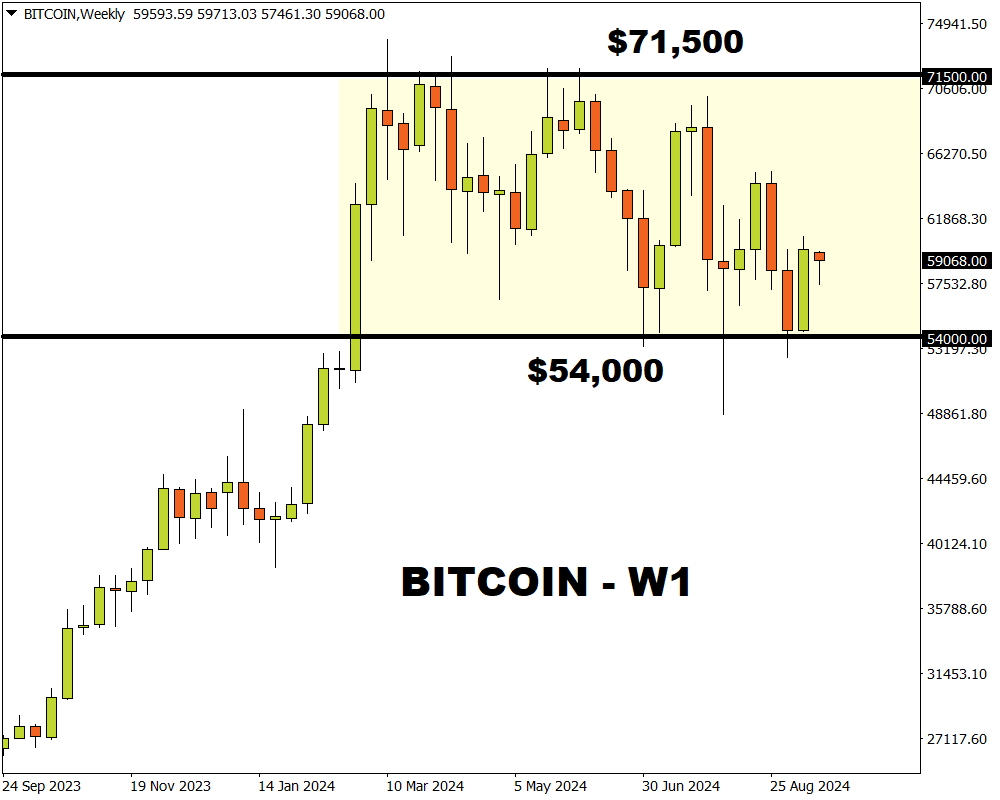

- Bitcoin trapped in range on W1 chart

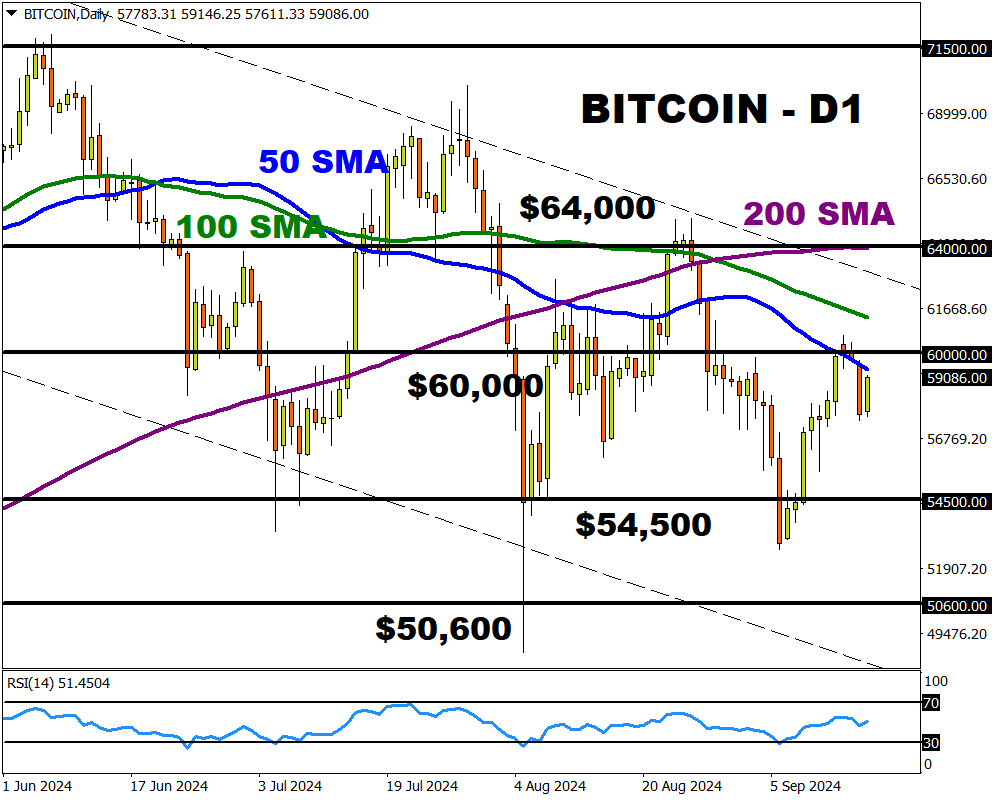

- Technical levels - $64,000, $60,000 & $54,500

As the Federal Reserve prepares for its first interest rate cut in 4 years, the cryptocurrency market is on edge.

This major event could inject Bitcoin with fresh volatility, leading to significant price swings.

Note: Bitcoin has been trapped within this range since March 2024.

The past few weeks have certainly been choppy for the world’s largest cryptocurrency due to recession fears and significant outflows from exchange-traded funds. However, bulls seem to be making a return thanks to rising US rate cut bets with Bitcoin ETFs seeing roughly $263 million in inflows last Friday!

Lower US interest rates could signal looser financial conditions, essentially boosting appetite for riskier assets such as cryptocurrencies. So, the Fed cutting rates on Wednesday may be a welcome development for Bitcoin bulls.

However, markets widely expect the Fed to move ahead with a 25-basis point cut but remain divided on a 50-basis point move.

Traders are currently pricing in a 70% probability that the Fed moves ahead with a 50-basis point cut.

Powell’s press conference and economic projections – especially the dot plot may provide fresh insight into future policy moves.

Golden nugget: Over the past 12 months, the Fed decision has triggered upside moves of as much as 3.4% or declines of 2.5% in a 6-hour window post-release.

Potential scenarios for Bitcoin:

- Bitcoin prices may rally if the Fed moves ahead with a 50-basis point cut, expresses optimism over the US economy and signals further cuts down the road.

- A 25-basis point cut has the potential to push Bitcoin higher, but this needs to be accompanied by dovish language and dot plot signalling more cuts in the future.

- If the Fed cuts rates by 50 basis points but expresses concerns over the US economy, the risk-off mood may drag Bitcoin prices lower.

Note: US retail sales will be published on Tuesday afternoon and could trigger some market volatility. Over the past year, the US retail sales report has sparked upside moves of as much as 2.5% or declines of 2.2% in a 6-hour window post-release.

Technical outlook

Bitcoin remains in a bearish channel on the daily charts with prices trading below the 50, 100 and 200-day SMA.

- A solid breakout and daily close above $60,000 could encourage an incline toward the 200-day SMA at $64,000.

- Should $60,000 prove to be reliable resistance, this could trigger a selloff back toward $54,500.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.