Daily Market Analysis and Forex News

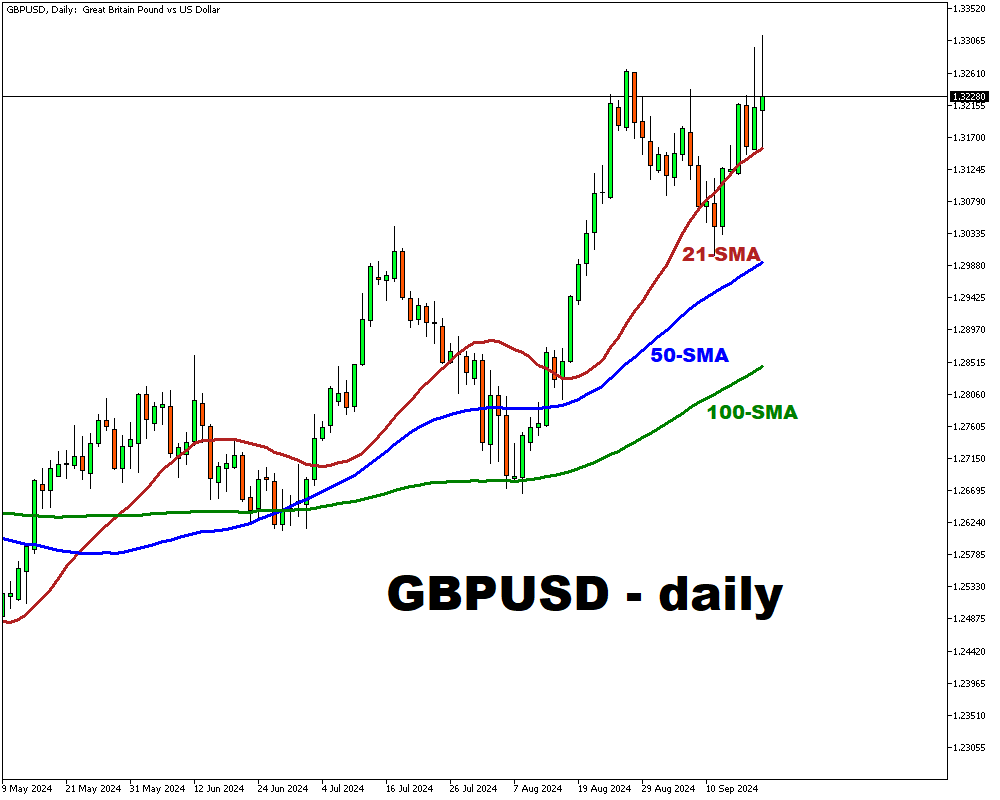

GBPUSD reaches new high!

- GBPUSD crosses 1.330, a new high since March 2022

- BoE maintains interest rates at 5.0%, aligning with markets

- Voting outcome was 8-1, with one dissenting voice

- Unanimous agreement on £100 billion bond reduction

- Persistent inflation indicators may influence future policy

GBPUSD reached new high, crossing the 1.330 for the first time since March 2022, following the BoE’s decision to keep the interest rates intact at 5.0%.

Bank of England decided to maintain current rates, following a 25-basis points reduction in August, marking the first decrease in over four years.

BoE move has aligned with what the markets have anticipated.

The unexpected aspect was the voting outcome, which showed an 8-1 split, with Swati Dhingra being the sole dissenting voice, contrasting with the expected 7-2 division.

This decision does not significantly alter the bank's rate forecast, as policymakers are currently adhering to a strategy of quarterly rate reductions, with a cut in November appearing to be the most probable scenario.

In terms of quantitative tightening, the committee reached a unanimous agreement to sustain the pace of reducing bond holdings by £100 billion over the next year, which was also in line with market expectations.

The only dovish signals were minor revisions to the GDP forecast for Q3 and the CPI outlook for Q4, which primarily reflect adjustments based on current market conditions and are subject to change with new data.

Looking forward, indicators of persistent inflation—such as tight labor market conditions, growth in private sector wages, and services CPI – are expected to continue influencing policy decisions.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.